This release was compiled during the COVID-19 pandemic. For further information see Technical Note – Impact of COVID-19 on the Earnings and Labour Costs release - updated Quarter 3 2020 and Press Statement Earnings and Labour Costs Quarter 2 2020 (Final) Quarter 3 2020 (Preliminary Estimate)

| Unadjusted | Seasonally Adjusted | |||||||

| Average Weekly Earnings | Average Hourly Earnings | Average Weekly Paid Hours | Average Hourly Total Labour Costs | Average Weekly Earnings | Average Hourly Earnings | Average Weekly Paid Hours | Average Hourly Total Labour Costs | |

| € | € | Hours | € | € | € | Hours | € | |

| Q3 2019 | 769.14 | 23.53 | 32.7 | 27.31 | 782.64 | 23.99 | 32.5 | 27.93 |

| Q2 2020 | 817.55 | 25.39 | 32.2 | 27.68 | 812.94 | 25.40 | 32.1 | 27.76 |

| Q3 2020* | 797.83 | 24.44 | 32.6 | 27.05 | 811.58 | 24.90 | 32.4 | 27.67 |

| Quarterly change % | -0.2 | -2.0 | 0.9 | -0.3 | ||||

| Annual change % | 3.7 | 3.9 | -0.3 | -1.0 | ||||

| * Preliminary Estimates | ||||||||

The COVID-19 crisis has had a significant impact on the Quarter 3 (Q3) 2020 data collection and the Q3 2020 Preliminary Estimates for the Earnings and Labour Costs release.

When considering the change in earnings, hours and labour costs, it should be noted that there may be a compositional effect due to the significant changes in employment in certain sectors. The composition of the labour market in Q3 2020 was very different to the composition of the labour market in both Q2 2020 and Q3 2019, against which the quarterly and annual changes are measured. Government measures were put in place in response to COVID-19, which resulted in the closures of non-esssential businesses at the end of Q1 2020. These restrictions were ultimately extended, with some sectors being affected for some or all weeks of Q2 2020. Some of these restrictions continued into Q3 2020. Across and within economic sectors the impact of the COVID-19 crisis was experienced very differently.

The CSO has published a technical note to accompany this release for users on the implications of the COVID-19 crisis on the Earnings and Labour Costs release. That technical note is available here Technical Note – Impact of COVID-19 on the Earnings and Labour Costs release - updated Quarter 3 2020. The detailed commentary usually provided on the Earnings and Labour Costs tables has not been included here but can be made available to users on request to earnings@cso.ie.

Preliminary estimates for Q3 2020

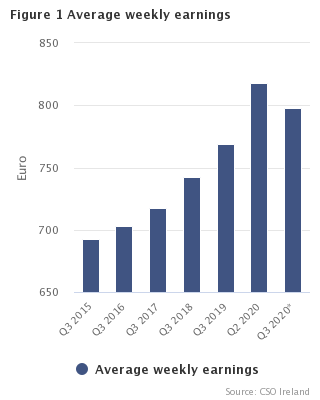

According to preliminary estimates of the Earnings and Labour Costs Quarterly release, average weekly earnings were €797.83 in Q3 2020, an increase of 3.7% from €769.14 one year earlier. This represents average earnings of those remaining in employment in the Irish economy in Q3 2020, including those supported by the Temporary Wage Subsidy Scheme (TWSS) and the Employment Wage Subsidy Scheme (EWSS).

When considering the change in earnings, it should be noted that there may be a compositional effect due to the significant changes in employment in certain sectors. The change in average weekly earnings may be impacted to some degree by those employments that have left or joined a sector having lower/higher average earnings than those employments that remained in the sector in both quarters.

Final data for average weekly earnings in Q2 2020 were €817.55 and showed an increase of 6.0% from the same period in 2019. See Tables 1 and 4.

Other features of the preliminary results for Q3 2020 include:

For frequently asked questions regarding data presented in this release, please see here.

Alongside the ELC release today, the Labour Market and Earnings analysis area of the CSO are also publishing the fourth in a series of high-level insight bulletins investigating the impact of COVID-19 on the labour market. The insight bulletin being published today is sourced from administrative datasets, namely Revenue's employee level tax data (PMOD) as well as data provided from Revenue in relation to the TWSS. This fourth bulletin is specifically designed to complement the Earnings & Labour Costs (ELC) results for Q3 2020 and is available here: Labour Market Insight Bulletin, Series 4

|

Note: While there is no internationally agreed methodology for assessing the public / private sector wage gap, the CSO has published analysis of the differential using a matched Labour Force Survey and P35 dataset for 2015-2018. This analysis took account of compositional differences between the public and private sector, such as occupational mix, sectors of activity, gender balance, union membership, etc. The public sector pay gap in 2018 was estimated to range from -3.8% to +0.1% depending on the specification applied and the treatment of the Pension Levy. See most recent analysis for 2015-2018 here. See also previous versions for 2007-2010 here (PDF 678KB) and for 2011-2014 here (PDF 686KB) . The average weekly earnings for 'All sectors' in Figure 7 has been amended. This had incorrectly shown the value for all sectors excluding semi-state. |

| 5 Year % Change | |

| Admin & support service | 21.7358693770794 |

| Accommodation & food | 21.4780313615898 |

| Information and communication | 19.8951754549871 |

| Construction | 18.9381899402947 |

| All sectors | 15.1618816668832 |

| Financial & real estate | 15.0743835337273 |

| Professional & technical | 15.0292067081214 |

| Arts & entertainment | 13.9963957779113 |

| Wholesale & retail | 13.8552525687335 |

| Education | 12.387175163658 |

| Health & social | 12.2195590358935 |

| Industry | 7.29970969801366 |

| Public admin & defence | 6.98295585160534 |

| Transportation | 4.86165954997523 |

| Nace code description |

|||

| Total | All Sectors | K-L | Financial, insurance and real estate activities |

| B-E | Industry | M | Professional, scientific and technical activities |

| F | Construction | N | Administrative and support service activities |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | O | Public Administration and defence; compulsory social security |

| H | Transportation and storage | P | Education |

| I | Accommodation and food service activities | Q | Human health and social work activities |

| J | Information and communication | R-S | Arts, entertainment, recreation and other service activities |

| Unadjusted | Seasonally Adjusted | |

| Q313 | 21.53 | 21.91 |

| Q413 | 21.89 | 21.87 |

| Q114 | 22.37 | 22 |

| Q214 | 21.81 | 21.8 |

| Q314 | 21.2 | 21.62 |

| Q414 | 22.05 | 22.04 |

| Q115 | 22.3 | 21.88 |

| Q215 | 21.86 | 21.85 |

| Q315 | 21.5 | 21.95 |

| Q415 | 21.91 | 21.9 |

| Q116 | 22.55 | 22.02 |

| Q216 | 21.97 | 22.05 |

| Q316 | 21.56 | 22.03 |

| Q416 | 22.18 | 22.17 |

| Q117 | 22.69 | 22.22 |

| Q217 | 22.27 | 22.28 |

| Q317 | 22.16 | 22.63 |

| Q417 | 22.6 | 22.59 |

| Q118 | 23.4 | 22.84 |

| Q218 | 22.94 | 23.04 |

| Q318 | 22.62 | 23.08 |

| Q418 | 23.33 | 23.33 |

| Q119 | 24.05 | 23.58 |

| Q219 | 23.69 | 23.7 |

| Q319 | 23.53 | 23.99 |

| Q419 | 24.23 | 24.23 |

| Q120 | 24.76 | 24.29 |

| Q220 | 25.39 | 25.4 |

| Q320* | 24.44 | 24.9 |

| Q3 2019 | Q3 2020* | |

| Industry | 23 | 23.57 |

| Construction | 21.42 | 21.51 |

| Wholesale & retail | 19.15 | 19.24 |

| Transportation | 23.24 | 21.99 |

| Accommodation & food | 13.37 | 15.65 |

| Information & communication | 33.41 | 35.49 |

| Financial & real estate | 30.99 | 32.29 |

| Professional & technical | 27.63 | 26.66 |

| Admin & support service | 18.7 | 19.89 |

| Public admin & defence | 25.96 | 26.47 |

| Education | 37.15 | 37.46 |

| Health & social | 23.41 | 24.05 |

| Arts & entertainment | 17.8 | 18.67 |

| All sectors | 23.53 | 24.44 |

| Unadjusted | Seasonally Adjusted | |

| Q313 | 31.7 | 31.6 |

| Q413 | 31.7 | 31.6 |

| Q114 | 31.3 | 31.7 |

| Q214 | 31.8 | 31.8 |

| Q314 | 31.9 | 31.8 |

| Q414 | 31.8 | 31.7 |

| Q115 | 31.4 | 31.9 |

| Q215 | 32 | 32 |

| Q315 | 32.2 | 32 |

| Q415 | 32.5 | 31.9 |

| Q116 | 31.7 | 31.9 |

| Q216 | 32.1 | 32 |

| Q316 | 32.6 | 32.2 |

| Q416 | 32.4 | 32.4 |

| Q117 | 32 | 32.4 |

| Q217 | 32.4 | 32.4 |

| Q317 | 32.4 | 32.2 |

| Q417 | 32.4 | 32.3 |

| Q118 | 31.8 | 32.4 |

| Q218 | 32.5 | 32.4 |

| Q318 | 32.8 | 32.5 |

| Q418 | 32.5 | 32.5 |

| Q119 | 32.1 | 32.5 |

| Q219 | 32.6 | 32.5 |

| Q319 | 32.7 | 32.5 |

| Q419 | 32.5 | 32.5 |

| Q120 | 32.3 | 32.5 |

| Q220 | 32.2 | 32.1 |

| Q320* | 32.6 | 32.4 |

| 5 Year % Change | |

| Information and communication | 20.181718061674 |

| Admin & support service | 13.5646687697161 |

| Financial & real estate | 13.2877102936983 |

| Education | 9.45589012150026 |

| All sectors | 8.89694041867955 |

| Health & social | 8.81870385561937 |

| Public admin & defence | 6.36197440585009 |

| Construction | 6.33379565418401 |

| Wholesale & retail | 5.83460172501268 |

| Industry | 4.73101869515452 |

| Professional & technical | 3.42393222732087 |

| Transportation | 2.55658005029338 |

| Arts & entertainment | -5.17782426778244 |

| Accommodation & food | -22.9790419161677 |

| Q3 2019 | Q3 2020* | |

| Civil service | 926.6 | 918.76 |

| Defence | 873.17 | 971.23 |

| Garda Siochana | 1340.2 | 1254.37 |

| Education | 1005.68 | 1034.11 |

| Regional bodies | 859.41 | 900.25 |

| Health | 919.34 | 958.42 |

| Semi-state | 1040.97 | 1047.98 |

| All sectors | 972.76 | 995.45 |

| Q3 2019 | Q3 2020* | |

| Civil service | 43500 | 44700 |

| Defence | 9000 | 8800 |

| Garda Siochana | 14500 | 14700 |

| Education | 112000 | 109200 |

| Regional bodies | 35100 | 35200 |

| Health | 137100 | 138800 |

| Semi-state | 56400 | 56300 |

| Job Vacancy Rate | |

| Q313 | 0.7 |

| Q413 | 0.7 |

| Q114 | 0.7 |

| Q214 | 0.7 |

| Q314 | 0.8 |

| Q414 | 0.7 |

| Q115 | 1 |

| Q215 | 0.9 |

| Q315 | 1 |

| Q415 | 0.9 |

| Q116 | 1 |

| Q216 | 0.9 |

| Q316 | 1 |

| Q416 | 0.9 |

| Q117 | 1 |

| Q217 | 1.1 |

| Q317 | 1.1 |

| Q417 | 1 |

| Q118 | 1 |

| Q218 | 1.2 |

| Q318 | 1 |

| Q418 | 0.9 |

| Q119 | 1 |

| Q219 | 1.1 |

| Q319 | 0.9 |

| Q419 | 0.9 |

| Q120 | 0.8 |

| Q220 | 0.7 |

| Q320* | 0.8 |

| Table 1 Average weekly earnings by economic sector and other characteristics and quarter | ||||||||||||

| NACE Principal Activity | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | |||

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||||||

| € | € | € | € | € | € | € | € | % | € | % | ||

| B-E | Industry | 830.17 | 837.85 | 851.78 | 875.54 | 883.24 | 900.64 | 890.77 | -9.87 | -1.1 | 7.53 | 0.9 |

| F | Construction | 698.43 | 735.24 | 739.38 | 796.07 | 804.64 | 769.12 | 830.70 | 61.58 | 8.0 | 26.06 | 3.2 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 534.31 | 545.81 | 553.10 | 566.53 | 597.26 | 600.41 | 608.34 | 7.93 | 1.3 | 11.08 | 1.9 |

| H | Transportation and storage | 747.07 | 753.28 | 774.54 | 818.45 | 833.22 | 807.64 | 783.39 | -24.25 | -3.0 | -49.83 | -6.0 |

| I | Accommodation and food services | 322.05 | 338.86 | 342.76 | 368.18 | 376.82 | 406.41 | 391.22 | -15.19 | -3.7 | 14.40 | 3.8 |

| J | Information and communication | 1,070.36 | 1,060.03 | 1,081.54 | 1,175.92 | 1,241.45 | 1,267.26 | 1,283.31 | 16.05 | 1.3 | 41.86 | 3.4 |

| K-L | Financial, insurance and real estate | 981.40 | 996.94 | 1,013.85 | 1,056.70 | 1,090.20 | 1,162.28 | 1,129.34 | -32.94 | -2.8 | 39.14 | 3.6 |

| M | Professional, scientific and technical activities | 796.05 | 839.70 | 879.19 | 901.37 | 948.00 | 921.64 | 915.69 | -5.95 | -0.6 | -32.31 | -3.4 |

| N | Administrative and support services | 519.97 | 519.79 | 544.43 | 575.02 | 607.68 | 610.42 | 632.99 | 22.57 | 3.7 | 25.31 | 4.2 |

| O | Public administration and defence | 913.51 | 919.44 | 940.42 | 945.47 | 966.73 | 998.27 | 977.30 | -20.97 | -2.1 | 10.57 | 1.1 |

| P | Education | 806.56 | 800.24 | 827.52 | 857.76 | 865.60 | 886.39 | 906.47 | 20.08 | 2.3 | 40.87 | 4.7 |

| Q | Human health and social work | 671.71 | 686.76 | 701.00 | 715.26 | 727.10 | 763.16 | 753.79 | -9.37 | -1.2 | 26.69 | 3.7 |

| R-S | Arts, entertainment, recreation and other service activities | 466.12 | 472.40 | 461.95 | 493.43 | 494.22 | 582.46 | 531.36 | -51.10 | -8.8 | 37.14 | 7.5 |

| All Sectors | 692.79 | 702.97 | 717.55 | 742.75 | 769.14 | 817.55 | 797.83 | -19.72 | -2.4 | 28.69 | 3.7 | |

| Public/Private Sector² | ||||||||||||

| Private sector | 631.26 | 644.83 | 655.87 | 681.70 | 709.30 | 753.43 | 736.72 | -16.71 | -2.2 | 27.42 | 3.9 | |

| Public sector¹ | 905.12 | 916.20 | 940.83 | 960.14 | 972.76 | 1,008.76 | 995.45 | -13.31 | -1.3 | 22.69 | 2.3 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 538.68 | 551.42 | 557.28 | 586.35 | 608.02 | 647.17 | 633.73 | -13.44 | -2.1 | 25.71 | 4.2 | |

| 50-250 employees | 651.01 | 645.49 | 660.07 | 684.16 | 706.26 | 740.76 | 744.30 | 3.54 | 0.5 | 38.04 | 5.4 | |

| Greater than 250 employees | 820.71 | 836.49 | 853.88 | 871.79 | 900.75 | 936.19 | 924.99 | -11.20 | -1.2 | 24.24 | 2.7 | |

| ¹ Average weekly earnings by Public sector sub-sector are set out in Table 8a. | ||||||||||||

| ² For additional Public/Private data see StatBank table EHQ08. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 2 Average hourly earnings by economic sector and other characteristics and quarter | ||||||||||||

| NACE Principal Activity | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | |||

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||||||

| € | € | € | € | € | € | € | € | % | € | % | ||

| B-E | Industry | 21.67 | 21.67 | 22.36 | 22.70 | 23.00 | 24.76 | 23.57 | -1.19 | -4.8 | 0.57 | 2.5 |

| F | Construction | 19.22 | 19.35 | 19.86 | 20.92 | 21.42 | 21.08 | 21.51 | 0.43 | 2.0 | 0.09 | 0.4 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 16.99 | 17.29 | 17.64 | 17.88 | 19.15 | 19.95 | 19.24 | -0.71 | -3.6 | 0.09 | 0.5 |

| H | Transportation and storage | 20.27 | 20.62 | 21.30 | 22.77 | 23.24 | 22.90 | 21.99 | -0.91 | -4.0 | -1.25 | -5.4 |

| I | Accommodation and food services | 12.07 | 12.43 | 12.55 | 12.87 | 13.37 | 15.70 | 15.65 | -0.05 | -0.3 | 2.28 | 17.1 |

| J | Information and communication | 29.30 | 28.96 | 29.76 | 31.93 | 33.41 | 34.28 | 35.49 | 1.21 | 3.5 | 2.08 | 6.2 |

| K-L | Financial, insurance and real estate | 27.93 | 28.26 | 29.28 | 30.02 | 30.99 | 33.75 | 32.29 | -1.46 | -4.3 | 1.30 | 4.2 |

| M | Professional, scientific and technical activities | 24.58 | 24.81 | 25.93 | 26.47 | 27.63 | 27.15 | 26.66 | -0.49 | -1.8 | -0.97 | -3.5 |

| N | Administrative and support services | 16.70 | 17.08 | 17.50 | 17.90 | 18.70 | 20.13 | 19.89 | -0.24 | -1.2 | 1.19 | 6.4 |

| O | Public administration and defence | 25.23 | 25.09 | 25.64 | 25.71 | 25.96 | 27.04 | 26.47 | -0.57 | -2.1 | 0.51 | 2.0 |

| P | Education | 34.31 | 33.79 | 34.92 | 36.10 | 37.15 | 36.50 | 37.46 | 0.96 | 2.6 | 0.31 | 0.8 |

| Q | Human health and social work | 21.96 | 22.05 | 22.63 | 22.79 | 23.41 | 24.05 | 24.05 | - | - | 0.64 | 2.7 |

| R-S | Arts, entertainment, recreation and other service activities | 16.68 | 16.67 | 16.33 | 17.02 | 17.80 | 19.92 | 18.67 | -1.25 | -6.3 | 0.87 | 4.9 |

| All Sectors | 21.50 | 21.56 | 22.16 | 22.62 | 23.53 | 25.39 | 24.44 | -0.95 | -3.7 | 0.91 | 3.9 | |

| Public/Private Sector² | ||||||||||||

| Private sector | 19.63 | 19.80 | 20.29 | 20.72 | 21.69 | 23.46 | 22.57 | -0.89 | -3.8 | 0.88 | 4.1 | |

| Public sector¹ | 27.89 | 28.02 | 28.89 | 29.44 | 29.82 | 31.04 | 30.48 | -0.56 | -1.8 | 0.66 | 2.2 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 17.69 | 17.86 | 18.32 | 18.82 | 19.59 | 21.04 | 20.11 | -0.93 | -4.4 | 0.52 | 2.7 | |

| 50-250 employees | 19.65 | 19.46 | 20.02 | 20.39 | 21.25 | 23.23 | 22.95 | -0.28 | -1.2 | 1.70 | 8.0 | |

| Greater than 250 employees | 24.73 | 24.86 | 25.45 | 25.86 | 26.81 | 28.28 | 27.64 | -0.64 | -2.3 | 0.83 | 3.1 | |

| ¹ Average hourly earnings by Public sector sub-sector are set out in Table 8b. | ||||||||||||

| ² For additional Public/Private data see statbank table EHQ08. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 3 Average weekly paid hours by economic sector and other characteristics and quarter | ||||||||||||

| NACE Principal Activity | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | |||

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||||||

| hours | hours | hours | hours | hours | hours | hours | hours | % | hours | % | ||

| B-E | Industry | 38.3 | 38.7 | 38.1 | 38.6 | 38.4 | 36.4 | 37.8 | 1.4 | 3.8 | -0.6 | -1.6 |

| F | Construction | 36.3 | 38.0 | 37.2 | 38.0 | 37.6 | 36.5 | 38.6 | 2.1 | 5.8 | 1.0 | 2.7 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 31.4 | 31.6 | 31.4 | 31.7 | 31.2 | 30.1 | 31.6 | 1.5 | 5.0 | 0.4 | 1.3 |

| H | Transportation and storage | 36.9 | 36.5 | 36.4 | 35.9 | 35.9 | 35.3 | 35.6 | 0.3 | 0.8 | -0.3 | -0.8 |

| I | Accommodation and food services | 26.7 | 27.3 | 27.3 | 28.6 | 28.2 | 25.9 | 25.0 | -0.9 | -3.5 | -3.2 | -11.3 |

| J | Information and communication | 36.5 | 36.6 | 36.3 | 36.8 | 37.2 | 37.0 | 36.2 | -0.8 | -2.2 | -1.0 | -2.7 |

| K-L | Financial, insurance and real estate | 35.1 | 35.3 | 34.6 | 35.2 | 35.2 | 34.4 | 35.0 | 0.6 | 1.7 | -0.2 | -0.6 |

| M | Professional, scientific and technical activities | 32.4 | 33.8 | 33.9 | 34.1 | 34.3 | 33.9 | 34.3 | 0.4 | 1.2 | - | - |

| N | Administrative and support services | 31.1 | 30.4 | 31.1 | 32.1 | 32.5 | 30.3 | 31.8 | 1.5 | 5.0 | -0.7 | -2.2 |

| O | Public administration and defence | 36.2 | 36.6 | 36.7 | 36.8 | 37.2 | 36.9 | 36.9 | - | - | -0.3 | -0.8 |

| P | Education | 23.5 | 23.7 | 23.7 | 23.8 | 23.3 | 24.3 | 24.2 | -0.1 | -0.4 | 0.9 | 3.9 |

| Q | Human health and social work | 30.6 | 31.1 | 31.0 | 31.4 | 31.1 | 31.7 | 31.3 | -0.4 | -1.3 | 0.2 | 0.6 |

| R-S | Arts, entertainment, recreation and other service activities | 27.9 | 28.3 | 28.3 | 29.0 | 27.8 | 29.2 | 28.5 | -0.7 | -2.4 | 0.7 | 2.5 |

| All Sectors | 32.2 | 32.6 | 32.4 | 32.8 | 32.7 | 32.2 | 32.6 | 0.4 | 1.2 | -0.1 | -0.3 | |

| Public/Private Sector² | ||||||||||||

| Private sector | 32.2 | 32.6 | 32.3 | 32.9 | 32.7 | 32.1 | 32.6 | 0.5 | 1.6 | -0.1 | -0.3 | |

| Public sector¹ | 32.5 | 32.7 | 32.6 | 32.6 | 32.6 | 32.5 | 32.7 | 0.2 | 0.6 | 0.1 | 0.3 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 30.5 | 30.9 | 30.4 | 31.2 | 31.0 | 30.8 | 31.5 | 0.7 | 2.3 | 0.5 | 1.6 | |

| 50-250 employees | 33.1 | 33.2 | 33.0 | 33.6 | 33.2 | 31.9 | 32.4 | 0.5 | 1.6 | -0.8 | -2.4 | |

| Greater than 250 employees | 33.2 | 33.7 | 33.6 | 33.7 | 33.6 | 33.1 | 33.5 | 0.4 | 1.2 | -0.1 | -0.3 | |

| ¹ Average weekly paid hours by Public sector sub-sector are set out in Table 8c. | ||||||||||||

| ² For additional Public/Private data see statbank table EHQ08. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 4 Earnings, hours and labour costs, unadjusted and seasonally adjusted by other characteristics and quarter | |||||||||||

| Unadjusted Series | Seasonally Adjusted Series | ||||||||||

| Quarter | Average weekly earnings | Average weekly paid hours | Average hourly earnings | Average hourly other labour costs | Average hourly total labour costs | Average weekly earnings | Average weekly paid hours | Average hourly earnings | Average hourly other labour costs | Average hourly total labour costs | |

| Q108 | 704.60 | 32.7 | 21.56 | 3.51 | 25.07 | 702.25 | 32.9 | 21.30 | 3.48 | 24.83 | |

| Q208 | 705.28 | 32.8 | 21.50 | 3.40 | 24.90 | 706.99 | 32.8 | 21.62 | 3.41 | 25.00 | |

| Q308 | 696.11 | 32.8 | 21.20 | 3.41 | 24.61 | 708.11 | 32.6 | 21.56 | 3.50 | 25.06 | |

| Q408 | 721.89 | 32.5 | 22.24 | 3.60 | 25.84 | 712.40 | 32.4 | 22.03 | 3.53 | 25.54 | |

| Q109 | 709.55 | 31.6 | 22.44 | 3.59 | 26.03 | 711.01 | 32.1 | 22.26 | 3.56 | 25.78 | |

| Q209 | 700.75 | 31.9 | 22.00 | 3.64 | 25.64 | 705.23 | 31.9 | 22.04 | 3.65 | 25.74 | |

| Q309 | 698.47 | 31.9 | 21.88 | 3.49 | 25.37 | 704.57 | 31.7 | 22.23 | 3.58 | 25.83 | |

| Q409 | 721.28 | 32.1 | 22.50 | 3.66 | 26.16 | 703.58 | 31.5 | 22.31 | 3.58 | 25.87 | |

| Q110 | 689.32 | 31.0 | 22.21 | 3.36 | 25.58 | 701.41 | 31.9 | 22.02 | 3.33 | 25.32 | |

| Q210 | 696.90 | 31.6 | 22.03 | 3.30 | 25.33 | 698.83 | 31.6 | 22.06 | 3.31 | 25.42 | |

| Q310 | 700.23 | 32.2 | 21.78 | 3.14 | 24.91 | 697.10 | 31.5 | 22.12 | 3.23 | 25.35 | |

| Q410 | 704.11 | 31.8 | 22.14 | 3.27 | 25.41 | 693.77 | 31.5 | 21.99 | 3.19 | 25.16 | |

| Q111 | 684.87 | 30.9 | 22.18 | 3.13 | 25.31 | 689.04 | 31.5 | 21.96 | 3.11 | 25.04 | |

| Q211 | 687.49 | 31.4 | 21.90 | 3.14 | 25.04 | 690.22 | 31.4 | 21.92 | 3.15 | 25.11 | |

| Q311 | 686.59 | 31.8 | 21.57 | 3.08 | 24.65 | 689.29 | 31.5 | 21.91 | 3.18 | 25.09 | |

| Q411 | 696.84 | 31.6 | 22.06 | 3.29 | 25.35 | 689.44 | 31.5 | 21.96 | 3.20 | 25.13 | |

| Q112 | 698.71 | 31.4 | 22.25 | 3.25 | 25.50 | 692.72 | 31.6 | 21.99 | 3.23 | 25.20 | |

| Q212 | 691.62 | 31.5 | 21.96 | 3.28 | 25.24 | 692.83 | 31.5 | 21.96 | 3.29 | 25.30 | |

| Q312 | 692.13 | 31.7 | 21.82 | 3.31 | 25.12 | 698.24 | 31.5 | 22.17 | 3.41 | 25.59 | |

| Q412 | 691.84 | 31.6 | 21.90 | 3.59 | 25.49 | 688.55 | 31.6 | 21.85 | 3.50 | 25.31 | |

| Q113 | 693.21 | 31.2 | 22.24 | 3.46 | 25.70 | 693.84 | 31.6 | 21.84 | 3.44 | 25.35 | |

| Q213 | 695.65 | 31.6 | 22.02 | 3.32 | 25.34 | 693.39 | 31.6 | 22.09 | 3.34 | 25.39 | |

| Q313 | 682.79 | 31.7 | 21.53 | 3.23 | 24.77 | 692.67 | 31.6 | 21.91 | 3.33 | 25.25 | |

| Q413 | 694.03 | 31.7 | 21.89 | 3.73 | 25.62 | 695.15 | 31.6 | 21.87 | 3.64 | 25.47 | |

| Q114 | 699.67 | 31.3 | 22.37 | 3.41 | 25.78 | 691.99 | 31.7 | 22.00 | 3.39 | 25.38 | |

| Q214 | 694.08 | 31.8 | 21.81 | 3.38 | 25.19 | 694.59 | 31.8 | 21.80 | 3.39 | 25.24 | |

| Q314 | 676.58 | 31.9 | 21.20 | 3.27 | 24.47 | 691.23 | 31.8 | 21.62 | 3.36 | 24.97 | |

| Q414 | 702.07 | 31.8 | 22.05 | 3.51 | 25.56 | 698.44 | 31.7 | 22.04 | 3.43 | 25.44 | |

| Q115 | 701.11 | 31.4 | 22.30 | 3.46 | 25.76 | 698.60 | 31.9 | 21.88 | 3.44 | 25.31 | |

| Q215 | 699.22 | 32.0 | 21.86 | 3.45 | 25.31 | 698.77 | 32.0 | 21.85 | 3.46 | 25.36 | |

| Q315 | 692.79 | 32.2 | 21.50 | 3.35 | 24.84 | 702.20 | 32.0 | 21.95 | 3.44 | 25.36 | |

| Q415 | 711.23 | 32.5 | 21.91 | 3.46 | 25.37 | 700.15 | 31.9 | 21.90 | 3.39 | 25.27 | |

| Q116 | 714.26 | 31.7 | 22.55 | 3.51 | 26.06 | 704.38 | 31.9 | 22.02 | 3.49 | 25.58 | |

| Q216 | 706.33 | 32.1 | 21.97 | 3.48 | 25.45 | 705.11 | 32.0 | 22.05 | 3.48 | 25.50 | |

| Q316 | 702.97 | 32.6 | 21.56 | 3.47 | 25.04 | 709.04 | 32.2 | 22.03 | 3.56 | 25.57 | |

| Q416 | 717.52 | 32.4 | 22.18 | 3.58 | 25.76 | 714.73 | 32.4 | 22.17 | 3.51 | 25.67 | |

| Q117 | 725.12 | 32.0 | 22.69 | 3.53 | 26.22 | 719.42 | 32.4 | 22.22 | 3.52 | 25.70 | |

| Q217 | 720.52 | 32.4 | 22.27 | 3.59 | 25.86 | 722.69 | 32.4 | 22.28 | 3.58 | 25.92 | |

| Q317 | 717.55 | 32.4 | 22.16 | 3.50 | 25.65 | 724.99 | 32.2 | 22.63 | 3.59 | 26.20 | |

| Q417 | 731.86 | 32.4 | 22.60 | 3.70 | 26.31 | 730.25 | 32.3 | 22.59 | 3.63 | 26.23 | |

| Q118 | 744.76 | 31.8 | 23.40 | 3.65 | 27.06 | 741.79 | 32.4 | 22.84 | 3.64 | 26.51 | |

| Q218 | 745.09 | 32.5 | 22.94 | 3.63 | 26.57 | 742.98 | 32.4 | 23.04 | 3.62 | 26.64 | |

| Q318 | 742.75 | 32.8 | 22.62 | 3.50 | 26.12 | 751.96 | 32.5 | 23.08 | 3.59 | 26.69 | |

| Q418 | 757.21 | 32.5 | 23.33 | 3.67 | 27.00 | 757.28 | 32.5 | 23.33 | 3.60 | 26.92 | |

| Q119 | 771.60 | 32.1 | 24.05 | 3.69 | 27.74 | 764.98 | 32.5 | 23.58 | 3.68 | 27.16 | |

| Q219 | 771.63 | 32.6 | 23.69 | 3.81 | 27.51 | 770.19 | 32.5 | 23.70 | 3.80 | 27.59 | |

| Q319 | 769.14 | 32.7 | 23.53 | 3.77 | 27.31 | 782.64 | 32.5 | 23.99 | 3.86 | 27.93 | |

| Q419 | 786.33 | 32.5 | 24.23 | 3.96 | 28.19 | 789.68 | 32.5 | 24.23 | 3.89 | 28.08 | |

| Q120 | 800.31 | 32.3 | 24.76 | 3.86 | 28.62 | 790.50 | 32.5 | 24.29 | 3.85 | 28.02 | |

| Q220 | 817.55 | 32.2 | 25.39 | 2.29 | 27.68 | 812.94 | 32.1 | 25.40 | 2.28 | 27.76 | |

| Q320* | 797.83 | 32.6 | 24.44 | 2.61 | 27.05 | 811.58 | 32.4 | 24.90 | 2.70 | 27.67 | |

| *Preliminary Estimates | |||||||||||

| Table 5a Average hourly earnings excluding irregular earnings by economic sector and other characteristics and quarter¹ | ||||||||||||

| NACE Principal Activity | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | |||

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||||||

| € | € | € | € | € | € | € | € | % | € | % | ||

| B-E | Industry | 20.77 | 20.71 | 21.37 | 21.70 | 22.11 | 23.11 | 22.64 | -0.47 | -2.0 | 0.53 | 2.4 |

| F | Construction | 18.90 | 19.11 | 19.38 | 20.40 | 21.04 | 20.82 | 20.98 | 0.16 | 0.8 | -0.06 | -0.3 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 16.30 | 16.62 | 16.98 | 17.23 | 18.20 | 18.79 | 18.43 | -0.36 | -1.9 | 0.23 | 1.3 |

| H | Transportation and storage | 19.56 | 19.82 | 20.47 | 21.76 | 22.35 | 21.34 | 21.14 | -0.20 | -0.9 | -1.21 | -5.4 |

| I | Accommodation and food services | 11.82 | 12.17 | 12.30 | 12.61 | 13.12 | 15.33 | 15.13 | -0.20 | -1.3 | 2.01 | 15.3 |

| J | Information and communication | 26.54 | 25.92 | 26.47 | 27.48 | 28.18 | 29.20 | 29.76 | 0.56 | 1.9 | 1.58 | 5.6 |

| K-L | Financial, insurance and real estate | 27.07 | 27.23 | 28.34 | 29.12 | 30.12 | 31.60 | 31.33 | -0.27 | -0.9 | 1.21 | 4.0 |

| M | Professional, scientific and technical activities | 23.46 | 23.58 | 24.59 | 24.92 | 26.26 | 25.58 | 25.58 | - | - | -0.68 | -2.6 |

| N | Administrative and support services | 16.02 | 16.42 | 16.79 | 16.96 | 17.72 | 18.84 | 18.87 | 0.03 | 0.2 | 1.15 | 6.5 |

| O | Public administration and defence | 24.26 | 24.07 | 24.39 | 24.60 | 24.86 | 25.47 | 25.21 | -0.26 | -1.0 | 0.35 | 1.4 |

| P | Education | 34.03 | 33.49 | 34.51 | 35.78 | 36.72 | 36.30 | 37.25 | 0.95 | 2.6 | 0.53 | 1.4 |

| Q | Human health and social work | 21.05 | 21.11 | 21.67 | 21.83 | 22.43 | 23.09 | 23.11 | 0.02 | 0.1 | 0.68 | 3.0 |

| R-S | Arts, entertainment, recreation and other service activities | 16.29 | 16.24 | 15.94 | 16.52 | 17.27 | 19.31 | 18.37 | -0.94 | -4.9 | 1.10 | 6.4 |

| All Sectors | 20.68 | 20.71 | 21.25 | 21.64 | 22.49 | 23.98 | 23.38 | -0.60 | -2.5 | 0.89 | 4.0 | |

| Public/Private Sector³ | ||||||||||||

| Private sector | 18.87 | 19.01 | 19.45 | 19.78 | 20.68 | 22.00 | 21.51 | -0.49 | -2.2 | 0.83 | 4.0 | |

| Public sector² | 26.87 | 26.93 | 27.72 | 28.31 | 28.68 | 29.80 | 29.41 | -0.39 | -1.3 | 0.73 | 2.5 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 17.26 | 17.46 | 17.89 | 18.28 | 19.04 | 20.26 | 19.52 | -0.74 | -3.7 | 0.48 | 2.5 | |

| 50-250 employees | 18.95 | 18.69 | 19.28 | 19.65 | 20.49 | 21.91 | 22.11 | 0.20 | 0.9 | 1.62 | 7.9 | |

| Greater than 250 employees | 23.61 | 23.67 | 24.18 | 24.52 | 25.36 | 26.52 | 26.21 | -0.31 | -1.2 | 0.85 | 3.4 | |

| ¹ Average hourly earnings excluding irregular earnings plus the average hourly irregular earnings in Table 5b equal average hourly earnings as set out in Table 2. | ||||||||||||

| ² Average hourly earnings excluding irregular earnings by Public sector sub-sector are set out in Table 8d. | ||||||||||||

| ³ For additional Public/Private data see statbank table EHQ08. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 5b Average hourly irregular earnings by economic sector and other characteristics and quarter¹ | ||||||||||

| NACE Principal Activity | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | |

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||||

| € | € | € | € | € | € | € | € | € | ||

| B-E | Industry | 0.90 | 0.96 | 0.99 | 1.01 | 0.90 | 1.64 | 0.93 | -0.71 | 0.03 |

| F | Construction | 0.32 | 0.25 | 0.48 | 0.52 | 0.38 | 0.26 | 0.53 | 0.27 | 0.15 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 0.69 | 0.68 | 0.66 | 0.66 | 0.95 | 1.16 | 0.81 | -0.35 | -0.14 |

| H | Transportation and storage | 0.72 | 0.80 | 0.83 | 1.01 | 0.89 | 1.56 | 0.85 | -0.71 | -0.04 |

| I | Accommodation and food services | 0.24 | 0.26 | 0.25 | 0.26 | 0.25 | 0.37 | 0.51 | 0.14 | 0.26 |

| J | Information and communication | 2.76 | 3.04 | 3.29 | 4.45 | 5.23 | 5.07 | 5.73 | 0.66 | 0.50 |

| K-L | Financial, insurance and real estate | 0.86 | 1.03 | 0.94 | 0.90 | 0.87 | 2.15 | 0.96 | -1.19 | 0.09 |

| M | Professional, scientific and technical activities | 1.12 | 1.22 | 1.34 | 1.55 | 1.36 | 1.57 | 1.08 | -0.49 | -0.28 |

| N | Administrative and support services | 0.67 | 0.66 | 0.71 | 0.94 | 0.98 | 1.29 | 1.02 | -0.27 | 0.04 |

| O | Public administration and defence | 0.97 | 1.02 | 1.25 | 1.12 | 1.10 | 1.57 | 1.26 | -0.31 | 0.16 |

| P | Education | 0.29 | 0.30 | 0.42 | 0.33 | 0.43 | 0.20 | 0.21 | 0.01 | -0.22 |

| Q | Human health and social work | 0.92 | 0.94 | 0.95 | 0.96 | 0.98 | 0.96 | 0.94 | -0.02 | -0.04 |

| R-S | Arts, entertainment, recreation and other service activities | 0.39 | 0.43 | 0.40 | 0.50 | 0.53 | 0.61 | 0.31 | -0.30 | -0.22 |

| All Sectors | 0.81 | 0.85 | 0.91 | 0.98 | 1.04 | 1.41 | 1.06 | -0.35 | 0.02 | |

| Public/Private Sector³ | ||||||||||

| Private sector | 0.75 | 0.79 | 0.83 | 0.94 | 1.02 | 1.46 | 1.06 | -0.40 | 0.04 | |

| Public sector² | 1.02 | 1.08 | 1.16 | 1.12 | 1.13 | 1.24 | 1.07 | -0.17 | -0.06 | |

| Size of Enterprise | ||||||||||

| Less than 50 employees | 0.42 | 0.41 | 0.43 | 0.54 | 0.55 | 0.78 | 0.58 | -0.20 | 0.03 | |

| 50-250 employees | 0.70 | 0.77 | 0.74 | 0.74 | 0.76 | 1.31 | 0.85 | -0.46 | 0.09 | |

| Greater than 250 employees | 1.12 | 1.18 | 1.27 | 1.35 | 1.45 | 1.76 | 1.43 | -0.33 | -0.02 | |

| ¹ Average hourly irregular earnings plus the average hourly earnings excluding irregular earnings in Table 5a equal average hourly earnings as set out in Table 2. | ||||||||||

| ² Average hourly earnings excluding irregular earnings by Public sector sub-sector are set out in Table 8d. | ||||||||||

| ³ For additional Public/Private data see statbank table EHQ08. | ||||||||||

| * Preliminary Estimates | ||||||||||

| Table 6a Average hourly other labour costs by economic sector and other characteristics and quarter | ||||||||||||

| NACE Principal Activity | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | |||

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||||||

| € | € | € | € | € | € | € | € | % | € | % | ||

| B-E | Industry | 4.54 | 5.01 | 4.69 | 4.61 | 5.22 | 3.44 | 3.88 | 0.44 | 12.8 | -1.34 | -25.7 |

| F | Construction | 2.41 | 2.42 | 2.43 | 2.53 | 2.65 | -0.66 | 1.49 | 2.15 | 325.8 | -1.16 | -43.8 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 2.72 | 2.84 | 2.91 | 2.79 | 3.04 | 0.72 | 1.61 | 0.89 | 123.6 | -1.43 | -47.0 |

| H | Transportation and storage | 3.59 | 3.35 | 3.47 | 3.74 | 3.72 | 1.08 | 2.48 | 1.40 | 129.6 | -1.24 | -33.3 |

| I | Accommodation and food services | 1.29 | 1.31 | 1.35 | 1.38 | 1.44 | -5.79 | -5.35 | 0.44 | 7.6 | -6.79 | -471.5 |

| J | Information and communication | 7.02 | 6.91 | 7.40 | 7.99 | 7.81 | 7.25 | 8.16 | 0.91 | 12.6 | 0.35 | 4.5 |

| K-L | Financial, insurance and real estate | 7.14 | 7.18 | 7.56 | 7.93 | 7.94 | 8.20 | 7.44 | -0.76 | -9.3 | -0.50 | -6.3 |

| M | Professional, scientific and technical activities | 3.75 | 4.02 | 4.19 | 4.10 | 4.53 | 1.89 | 2.64 | 0.75 | 39.7 | -1.89 | -41.7 |

| N | Administrative and support services | 2.33 | 2.35 | 2.41 | 2.49 | 3.14 | 1.06 | 1.71 | 0.65 | 61.3 | -1.43 | -45.5 |

| O | Public administration and defence | 2.13 | 2.13 | 2.26 | 2.36 | 2.47 | 2.64 | 2.62 | -0.02 | -0.8 | 0.15 | 6.1 |

| P | Education | 3.54 | 3.65 | 3.77 | 3.84 | 4.03 | 3.33 | 3.98 | 0.65 | 19.5 | -0.05 | -1.2 |

| Q | Human health and social work | 2.41 | 2.41 | 2.49 | 2.56 | 2.66 | 2.18 | 2.48 | 0.30 | 13.8 | -0.18 | -6.8 |

| R-S | Arts, entertainment, recreation and other service activities | 2.44 | 2.94 | 2.17 | 2.26 | 2.51 | -1.37 | -0.54 | 0.83 | 60.6 | -3.05 | -121.5 |

| All Sectors | 3.35 | 3.47 | 3.50 | 3.50 | 3.77 | 2.29 | 2.61 | 0.32 | 14.0 | -1.16 | -30.8 | |

| Public/Private Sector¹ | ||||||||||||

| Private sector | 3.45 | 3.58 | 3.58 | 3.56 | 3.87 | 1.88 | 2.32 | 0.44 | 23.4 | -1.55 | -40.1 | |

| Public sector | 3.01 | 3.07 | 3.20 | 3.30 | 3.44 | 3.53 | 3.54 | 0.01 | 0.3 | 0.10 | 2.9 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 2.39 | 2.65 | 2.52 | 2.45 | 2.60 | -0.51 | 0.53 | 1.04 | 203.9 | -2.07 | -79.6 | |

| 50-250 employees | 3.15 | 3.07 | 3.11 | 3.27 | 3.43 | 1.00 | 1.86 | 0.86 | 86.0 | -1.57 | -45.8 | |

| Greater than 250 employees | 4.06 | 4.19 | 4.27 | 4.25 | 4.63 | 4.13 | 4.16 | 0.03 | 0.7 | -0.47 | -10.2 | |

| ¹ For additional Public/Private data see statbank table EHQ08. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 6b Average hourly benefits in kind (BIK) by economic sector and other characteristics and quarter¹ | ||||||||||

| NACE Principal Activity | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | |

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||||

| € | € | € | € | € | € | € | € | € | ||

| B-E | Industry | 0.20 | 0.21 | 0.22 | 0.20 | 0.19 | 0.62 | 0.17 | -0.45 | -0.02 |

| F | Construction | 0.05 | 0.07 | 0.08 | 0.06 | 0.09 | 0.07 | 0.08 | 0.01 | -0.01 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 0.24 | 0.24 | 0.26 | 0.26 | 0.33 | 0.57 | 0.28 | -0.29 | -0.05 |

| H | Transportation and storage | 0.11 | 0.09 | 0.10 | 0.11 | 0.11 | 0.09 | 0.10 | 0.01 | -0.01 |

| I | Accommodation and food services | 0.03 | 0.02 | 0.02 | 0.02 | 0.02 | 0.03 | 0.02 | -0.01 | - |

| J | Information and communication | 1.63 | 1.67 | 2.09 | 2.29 | 1.79 | 1.72 | 2.40 | 0.68 | 0.61 |

| K-L | Financial, insurance and real estate | 0.78 | 0.78 | 0.53 | 0.87 | 0.64 | 1.09 | 0.43 | -0.66 | -0.21 |

| M | Professional, scientific and technical activities | 0.25 | 0.28 | 0.31 | 0.22 | 0.44 | 0.49 | 0.26 | -0.23 | -0.18 |

| N | Administrative and support services | 0.12 | 0.11 | 0.11 | 0.15 | 0.50 | 0.19 | 0.25 | 0.06 | -0.25 |

| O | Public administration and defence | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | - | - |

| P | Education | 0.01 | 0.01 | 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | - | -0.01 |

| Q | Human health and social work | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | -0.01 | -0.01 |

| R-S | Arts, entertainment, recreation and other service activities | 0.10 | 0.85 | 0.14 | 0.08 | 0.09 | 0.14 | 0.09 | -0.05 | - |

| All Sectors | 0.22 | 0.25 | 0.24 | 0.25 | 0.27 | 0.40 | 0.25 | -0.15 | -0.02 | |

| Public/Private Sector² | ||||||||||

| Private sector | 0.28 | 0.31 | 0.30 | 0.32 | 0.34 | 0.53 | 0.32 | -0.21 | -0.02 | |

| Public sector | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.01 | - | -0.01 | |

| Size of Enterprise | ||||||||||

| Less than 50 employees | 0.16 | 0.15 | 0.14 | 0.14 | 0.18 | 0.20 | 0.16 | -0.04 | -0.02 | |

| 50-250 employees | 0.22 | 0.20 | 0.16 | 0.24 | 0.20 | 0.30 | 0.27 | -0.03 | 0.07 | |

| Greater than 250 employees | 0.26 | 0.33 | 0.33 | 0.34 | 0.35 | 0.53 | 0.30 | -0.23 | -0.05 | |

| ¹ Average hourly benefits in kind (BIK) are a sub-component of average hourly other labour costs as set out in Table 6a. BIK is considered an income rather than an other labour cost by | ||||||||||

| Eurostat and in Structure of Earnings Statistics | ||||||||||

| ² For additional Public/Private data see statbank table EHQ08. | ||||||||||

| * Preliminary Estimates | ||||||||||

| Table 6c Average hourly total labour costs by economic sector and other characteristics and quarter¹ | ||||||||||||

| NACE Principal Activity | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | |||

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||||||

| € | € | € | € | € | € | € | € | % | € | % | ||

| B-E | Industry | 26.21 | 26.69 | 27.06 | 27.31 | 28.22 | 28.20 | 27.45 | -0.75 | -2.7 | -0.77 | -2.7 |

| F | Construction | 21.63 | 21.77 | 22.29 | 23.45 | 24.07 | 20.42 | 23.00 | 2.58 | 12.6 | -1.07 | -4.4 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 19.71 | 20.13 | 20.55 | 20.67 | 22.19 | 20.67 | 20.86 | 0.19 | 0.9 | -1.33 | -6.0 |

| H | Transportation and storage | 23.86 | 23.97 | 24.78 | 26.51 | 26.96 | 23.98 | 24.47 | 0.49 | 2.0 | -2.49 | -9.2 |

| I | Accommodation and food services | 13.36 | 13.74 | 13.90 | 14.25 | 14.80 | 9.91 | 10.29 | 0.38 | 3.8 | -4.51 | -30.5 |

| J | Information and communication | 36.32 | 35.87 | 37.16 | 39.93 | 41.22 | 41.53 | 43.65 | 2.12 | 5.1 | 2.43 | 5.9 |

| K-L | Financial, insurance and real estate | 35.07 | 35.43 | 36.83 | 37.95 | 38.93 | 41.95 | 39.73 | -2.22 | -5.3 | 0.80 | 2.1 |

| M | Professional, scientific and technical activities | 28.33 | 28.83 | 30.12 | 30.57 | 32.16 | 29.04 | 29.30 | 0.26 | 0.9 | -2.86 | -8.9 |

| N | Administrative and support services | 19.02 | 19.43 | 19.91 | 20.39 | 21.85 | 21.19 | 21.60 | 0.41 | 1.9 | -0.25 | -1.1 |

| O | Public administration and defence | 27.35 | 27.22 | 27.90 | 28.07 | 28.44 | 29.68 | 29.09 | -0.59 | -2.0 | 0.65 | 2.3 |

| P | Education | 37.86 | 37.44 | 38.69 | 39.94 | 41.18 | 39.83 | 41.44 | 1.61 | 4.0 | 0.26 | 0.6 |

| Q | Human health and social work | 24.38 | 24.47 | 25.12 | 25.35 | 26.07 | 26.23 | 26.53 | 0.30 | 1.1 | 0.46 | 1.8 |

| R-S | Arts, entertainment, recreation and other service activities | 19.12 | 19.61 | 18.50 | 19.28 | 20.31 | 18.55 | 18.13 | -0.42 | -2.3 | -2.18 | -10.7 |

| All Sectors | 24.84 | 25.04 | 25.65 | 26.12 | 27.31 | 27.68 | 27.05 | -0.63 | -2.3 | -0.26 | -1.0 | |

| Public/Private Sector² | ||||||||||||

| Private sector | 23.07 | 23.38 | 23.86 | 24.28 | 25.56 | 25.34 | 24.89 | -0.45 | -1.8 | -0.67 | -2.6 | |

| Public sector | 30.90 | 31.09 | 32.09 | 32.73 | 33.25 | 34.57 | 34.02 | -0.55 | -1.6 | 0.77 | 2.3 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 20.08 | 20.51 | 20.84 | 21.26 | 22.18 | 20.53 | 20.64 | 0.11 | 0.5 | -1.54 | -6.9 | |

| 50-250 employees | 22.80 | 22.54 | 23.13 | 23.66 | 24.68 | 24.22 | 24.81 | 0.59 | 2.4 | 0.13 | 0.5 | |

| Greater than 250 employees | 28.79 | 29.04 | 29.72 | 30.12 | 31.45 | 32.42 | 31.80 | -0.62 | -1.9 | 0.35 | 1.1 | |

| ¹ Average hourly total labour costs equal the average hourly earnings in Table 2 plus the average hourly other labour costs as set out in Table 6a. | ||||||||||||

| ² For additional Public/Private data see statbank table EHQ08. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 7a Employment by economic sector and other characteristics and quarter¹ | ||||||||||

| NACE Principal Activity | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | |

| Q3 | Q3 | Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||

| B-E | Industry | 199,900 | 199,900 | 211,800 | 226,400 | 232,600 | 231,200 | 238,300 | 233,500 | 244,000 |

| F | Construction | 60,800 | 67,600 | 77,600 | 87,600 | 91,100 | 109,600 | 111,600 | 95,700 | 107,200 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 279,700 | 285,500 | 285,900 | 299,700 | 306,300 | 302,800 | 301,900 | 286,200 | 310,400 |

| H | Transportation and storage | 60,600 | 61,000 | 63,500 | 68,300 | 69,000 | 78,000 | 83,300 | 74,100 | 81,600 |

| I | Accommodation and food services | 145,500 | 148,900 | 151,300 | 165,700 | 171,600 | 186,100 | 181,900 | 126,200 | 150,900 |

| J | Information and communication | 57,800 | 58,200 | 62,800 | 66,800 | 72,200 | 76,400 | 81,300 | 84,100 | 79,800 |

| K-L | Financial, insurance and real estate | 88,600 | 92,700 | 88,900 | 93,500 | 93,600 | 87,400 | 98,200 | 112,100 | 104,100 |

| M | Professional, scientific and technical activities | 80,500 | 84,200 | 94,000 | 96,700 | 93,100 | 94,800 | 92,200 | 98,700 | 101,300 |

| N | Administrative and support services | 75,200 | 78,000 | 83,200 | 80,400 | 91,000 | 102,800 | 108,300 | 87,100 | 88,400 |

| O | Public administration and defence | 105,800 | 109,500 | 113,600 | 111,000 | 115,800 | 125,900 | 139,000 | 144,800 | 144,500 |

| P | Education | 126,500 | 130,800 | 133,400 | 136,400 | 147,000 | 158,600 | 169,200 | 180,700 | 172,300 |

| Q | Human health and social work | 221,600 | 226,500 | 233,000 | 234,800 | 240,700 | 240,600 | 252,800 | 243,400 | 248,400 |

| R-S | Arts, entertainment, recreation and other service activities | 47,100 | 47,200 | 51,700 | 54,500 | 53,900 | 59,300 | 55,800 | 46,000 | 53,100 |

| All Sectors | 1,549,500 | 1,590,000 | 1,650,800 | 1,721,900 | 1,777,900 | 1,853,500 | 1,913,900 | 1,812,600 | 1,885,900 | |

| Public/Private Sector² | ||||||||||

| Private sector | 1,173,300 | 1,218,100 | 1,274,500 | 1,338,900 | 1,385,600 | 1,453,700 | 1,506,200 | 1,413,400 | 1,478,300 | |

| Public sector | 376,200 | 371,900 | 376,300 | 382,900 | 392,300 | 399,800 | 407,700 | 399,100 | 407,600 | |

| 1 It should be noted that the Labour Force Survey (LFS) is the official source of estimates of employment. | ||||||||||

| ² For additional Public/Private data see statbank table EHQ08. | ||||||||||

| * Preliminary Estimate | ||||||||||

| Table 7b Job vacancies by economic sector and other characteristics and quarter | ||||||||||

| NACE Principal Activity | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | |

| Q3 | Q3 | Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||

| B-E | Industry | 1,000 | 1,000 | 1,400 | 1,600 | 1,200 | 1,700 | 1,600 | 1,000 | 1,400 |

| F | Construction | 100 | 400 | 500 | 200 | 600 | 500 | 500 | 100 | 200 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 1,800 | 1,700 | 1,900 | 2,200 | 2,000 | 1,900 | 2,000 | 700 | 1,900 |

| H | Transportation and storage | 200 | 300 | 200 | 400 | 300 | 700 | 600 | 100 | 200 |

| I | Accommodation and food services | 500 | 600 | 1,300 | 1,100 | 1,500 | 1,700 | 900 | 1,100 | 400 |

| J | Information and communication | 1,700 | 1,600 | 1,900 | 1,000 | 1,400 | 1,400 | 1,500 | 900 | 1,100 |

| K-L | Financial, insurance and real estate | 1,600 | 1,400 | 2,100 | 2,100 | 2,400 | 2,200 | 2,100 | 1,000 | 1,000 |

| M | Professional, scientific and technical activities | 800 | 1,200 | 1,800 | 2,200 | 2,600 | 2,800 | 2,500 | 1,000 | 1,500 |

| N | Administrative and support services | 700 | 800 | 1,200 | 1,200 | 700 | 1,400 | 800 | 800 | 800 |

| O | Public administration and defence | 600 | 600 | 1,000 | 1,300 | 1,500 | 1,600 | 1,900 | 3,000 | 3,000 |

| P | Education | 600 | 600 | 800 | 1,100 | 1,000 | 1,300 | 1,700 | 2,100 | 2,100 |

| Q | Human health and social work | 1,800 | 1,800 | 2,300 | 3,200 | 3,300 | 1,500 | 1,400 | 1,600 | 1,700 |

| R-S | Arts, entertainment, recreation and other service activities | 200 | 600 | 500 | 600 | 500 | 500 | 500 | 300 | 600 |

| All Sectors | 11,500 | 12,500 | 16,800 | 18,200 | 18,900 | 19,200 | 17,900 | 13,700 | 15,900 | |

| Public/Private Sector¹ | ||||||||||

| Private sector | 9,500 | 10,300 | 13,300 | 13,500 | 14,000 | 15,900 | 14,100 | 8,600 | 11,000 | |

| Public sector | 2,000 | 2,200 | 3,600 | 4,700 | 4,900 | 3,300 | 3,800 | 5,100 | 4,900 | |

| ¹ For additional Public/Private data see statbank table EHQ08. | ||||||||||

| * Preliminary Estimates | ||||||||||

| Table 7c Job vacancy rate by economic sector and other characteristics and quarter | ||||||||||

| NACE Principal Activity | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | |

| Q3 | Q3 | Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | ||

| % | % | % | % | % | % | % | % | % | ||

| B-E | Industry | 0.5 | 0.5 | 0.6 | 0.7 | 0.5 | 0.7 | 0.7 | 0.4 | 0.6 |

| F | Construction | 0.1 | 0.6 | 0.6 | 0.2 | 0.7 | 0.4 | 0.4 | 0.1 | 0.2 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 0.6 | 0.6 | 0.7 | 0.7 | 0.7 | 0.6 | 0.6 | 0.2 | 0.6 |

| H | Transportation and storage | 0.3 | 0.5 | 0.3 | 0.6 | 0.4 | 0.9 | 0.8 | 0.2 | 0.2 |

| I | Accommodation and food services | 0.4 | 0.4 | 0.8 | 0.7 | 0.8 | 0.9 | 0.5 | 0.9 | 0.3 |

| J | Information and communication | 2.9 | 2.6 | 2.9 | 1.5 | 1.9 | 1.8 | 1.8 | 1.1 | 1.4 |

| K-L | Financial, insurance and real estate | 1.7 | 1.5 | 2.3 | 2.2 | 2.5 | 2.4 | 2.1 | 0.9 | 0.9 |

| M | Professional, scientific and technical activities | 1.0 | 1.4 | 1.9 | 2.2 | 2.7 | 2.8 | 2.7 | 1.0 | 1.5 |

| N | Administrative and support services | 0.9 | 1.0 | 1.4 | 1.5 | 0.8 | 1.4 | 0.7 | 0.9 | 0.8 |

| O | Public administration and defence | 0.6 | 0.6 | 0.9 | 1.2 | 1.3 | 1.3 | 1.4 | 2.0 | 2.0 |

| P | Education | 0.5 | 0.5 | 0.6 | 0.8 | 0.7 | 0.8 | 1.0 | 1.2 | 1.2 |

| Q | Human health and social work | 0.8 | 0.8 | 1.0 | 1.3 | 1.3 | 0.6 | 0.5 | 0.7 | 0.7 |

| R-S | Arts, entertainment, recreation and other service activities | 0.4 | 1.2 | 0.9 | 1.1 | 0.9 | 0.9 | 0.8 | 0.6 | 1.2 |

| All Sectors | 0.7 | 0.8 | 1.0 | 1.0 | 1.1 | 1.0 | 0.9 | 0.7 | 0.8 | |

| Public/Private Sector¹ | ||||||||||

| Private Sector | 0.8 | 0.8 | 1.0 | 1.0 | 1.0 | 1.1 | 0.9 | 0.6 | 0.7 | |

| Public Sector | 0.5 | 0.6 | 0.9 | 1.2 | 1.2 | 0.8 | 0.9 | 1.3 | 1.2 | |

| ¹ For additional Public/Private data see statbank table EHQ08. | ||||||||||

| * Preliminary Estimates | ||||||||||

| Table 8a Average weekly earnings by public sector sub-sector and quarter | |||||||||||

| Public sector sub-sector | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | ||

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | |||||

| € | € | € | € | € | € | € | € | % | € | % | |

| Civil service | 898.61 | 889.56 | 900.70 | 912.13 | 926.60 | 977.79 | 918.76 | -59.03 | -6.0 | -7.84 | -0.8 |

| Defence | 814.14 | 807.84 | 900.01 | 859.94 | 873.17 | 916.69 | 971.23 | 54.54 | 5.9 | 98.06 | 11.2 |

| Garda Siochana | 1,191.01 | 1,251.09 | 1,322.32 | 1,325.13 | 1,340.20 | 1,433.19 | 1,254.37 | -178.82 | -12.5 | -85.83 | -6.4 |

| Education | 925.14 | 931.30 | 966.69 | 995.93 | 1,005.68 | 1,018.61 | 1,034.11 | 15.50 | 1.5 | 28.43 | 2.8 |

| Regional bodies | 814.13 | 828.93 | 818.12 | 828.18 | 859.41 | 837.97 | 900.25 | 62.28 | 7.4 | 40.84 | 4.8 |

| Health | 853.06 | 870.33 | 888.91 | 906.31 | 919.34 | 998.18 | 958.42 | -39.76 | -4.0 | 39.08 | 4.3 |

| Semi-state | 987.27 | 999.82 | 1,017.42 | 1,039.17 | 1,040.97 | 1,040.39 | 1,047.98 | 7.59 | 0.7 | 7.01 | 0.7 |

| Total public sector | 905.12 | 916.20 | 940.83 | 960.14 | 972.76 | 1,008.76 | 995.45 | -13.31 | -1.3 | 22.69 | 2.3 |

| Total public sector excluding semi- state bodies | 891.61 | 903.00 | 928.79 | 947.75 | 962.11 | 1,003.81 | 987.00 | -16.81 | -1.7 | 24.89 | 2.6 |

| Semi-state by sub-sector | |||||||||||

| Non Commercial Semi-state bodies | 976.16 | 952.74 | 976.62 | 980.32 | 1,000.74 | 1,041.07 | 1,049.31 | 8.24 | 0.8 | 48.57 | 4.9 |

| Commercial Semi-state bodies | 991.49 | 1,016.14 | 1,032.08 | 1,062.27 | 1,057.55 | 1,040.10 | 1,047.42 | 7.32 | 0.7 | -10.13 | -1.0 |

| * Preliminary Estimates | |||||||||||

| Table 8b Average hourly earnings by public sector sub-sector and quarter | |||||||||||

| Public sector sub-sector | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | ||

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | |||||

| € | € | € | € | € | € | € | € | % | € | % | |

| Civil service | 25.01 | 24.65 | 24.92 | 24.99 | 25.14 | 25.48 | 25.25 | -0.23 | -0.9 | 0.11 | 0.4 |

| Defence | 22.93 | 22.74 | 25.34 | 24.13 | 24.63 | 25.95 | 25.75 | -0.20 | -0.8 | 1.12 | 4.5 |

| Garda Siochana | 28.82 | 29.01 | 29.70 | 30.07 | 30.42 | 33.58 | 31.90 | -1.68 | -5.0 | 1.48 | 4.9 |

| Education | 37.85 | 37.89 | 39.52 | 40.58 | 41.23 | 41.42 | 42.20 | 0.78 | 1.9 | 0.97 | 2.4 |

| Regional bodies | 22.96 | 22.95 | 22.94 | 23.29 | 23.36 | 23.81 | 23.81 | - | - | 0.45 | 1.9 |

| Health | 24.99 | 25.08 | 25.65 | 26.04 | 26.59 | 28.40 | 27.73 | -0.67 | -2.4 | 1.14 | 4.3 |

| Semi-state | 26.99 | 27.17 | 27.84 | 28.27 | 28.66 | 29.49 | 28.61 | -0.88 | -3.0 | -0.05 | -0.2 |

| Total public sector | 27.89 | 28.02 | 28.89 | 29.44 | 29.82 | 31.04 | 30.48 | -0.56 | -1.8 | 0.66 | 2.2 |

| Total public sector excluding semi-state bodies | 28.06 | 28.17 | 29.08 | 29.65 | 30.02 | 31.31 | 30.82 | -0.49 | -1.6 | 0.80 | 2.7 |

| Semi-state by sub-sector | |||||||||||

| Non Commercial Semi-state bodies | 28.28 | 27.60 | 28.29 | 28.20 | 28.82 | 29.67 | 29.71 | 0.04 | 0.1 | 0.89 | 3.1 |

| Commercial Semi-state bodies | 26.54 | 27.03 | 27.69 | 28.30 | 28.60 | 29.41 | 28.17 | -1.24 | -4.2 | -0.43 | -1.5 |

| * Preliminary Estimates | |||||||||||

| Table 8c Average weekly paid hours by public sector sub-sector and quarter | |||||||||||

| Public sector sub-sector | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | ||

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | |||||

| hours | hours | hours | hours | hours | hours | hours | hours | % | hours | % | |

| Civil service | 35.9 | 36.1 | 36.2 | 36.5 | 36.9 | 38.4 | 36.4 | -2.0 | -5.2 | -0.5 | -1.4 |

| Defence | 35.5 | 35.5 | 35.5 | 35.6 | 35.5 | 35.3 | 37.7 | 2.4 | 6.8 | 2.2 | 6.2 |

| Garda Siochana | 41.3 | 43.1 | 44.5 | 44.1 | 44.1 | 42.7 | 39.3 | -3.4 | -8.0 | -4.8 | -10.9 |

| Education | 24.4 | 24.6 | 24.5 | 24.5 | 24.4 | 24.6 | 24.5 | -0.1 | -0.4 | 0.1 | 0.4 |

| Regional bodies | 35.5 | 36.1 | 35.7 | 35.6 | 36.8 | 35.2 | 37.8 | 2.6 | 7.4 | 1.0 | 2.7 |

| Health | 34.1 | 34.7 | 34.7 | 34.8 | 34.6 | 35.1 | 34.6 | -0.5 | -1.4 | - | - |

| Semi-state | 36.6 | 36.8 | 36.5 | 36.8 | 36.3 | 35.3 | 36.6 | 1.3 | 3.7 | 0.3 | 0.8 |

| Total public sector | 32.5 | 32.7 | 32.6 | 32.6 | 32.6 | 32.5 | 32.7 | 0.2 | 0.6 | 0.1 | 0.3 |

| Total public sector excluding semi-state bodies | 31.8 | 32.1 | 31.9 | 32.0 | 32.0 | 32.1 | 32.0 | -0.1 | -0.3 | - | - |

| Semi-state by sub-sector | |||||||||||

| Non Commercial Semi-state bodies | 34.5 | 34.5 | 34.5 | 34.8 | 34.7 | 35.1 | 35.3 | 0.2 | 0.6 | 0.6 | 1.7 |

| Commercial Semi-state bodies | 37.4 | 37.6 | 37.3 | 37.5 | 37.0 | 35.4 | 37.2 | 1.8 | 5.1 | 0.2 | 0.5 |

| * Preliminary Estimates | |||||||||||

| Table 8d Average hourly earnings excluding irregular earnings by public sector sub-sector and quarter¹ | |||||||||||

| Public sector sub-sector | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change | ||

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | |||||

| € | € | € | € | € | € | € | € | % | € | % | |

| Civil service | 24.57 | 24.19 | 24.48 | 24.49 | 24.67 | 24.97 | 24.75 | -0.22 | -0.9 | 0.08 | 0.3 |

| Defence | 22.14 | 21.93 | 22.85 | 23.38 | 23.87 | 24.69 | 24.62 | -0.07 | -0.3 | 0.75 | 3.1 |

| Garda Siochana | 25.01 | 24.97 | 25.58 | 25.85 | 26.10 | 26.28 | 26.05 | -0.23 | -0.9 | -0.05 | -0.2 |

| Education | 37.55 | 37.57 | 39.11 | 40.20 | 40.74 | 41.21 | 41.97 | 0.76 | 1.8 | 1.23 | 3.0 |

| Regional bodies | 22.34 | 22.37 | 22.27 | 22.58 | 22.65 | 23.08 | 23.18 | 0.10 | 0.4 | 0.53 | 2.3 |

| Health | 23.62 | 23.68 | 24.25 | 24.63 | 25.13 | 26.95 | 26.37 | -0.58 | -2.2 | 1.24 | 4.9 |

| Semi-state | 25.81 | 25.77 | 26.45 | 26.83 | 27.42 | 28.06 | 27.63 | -0.43 | -1.5 | 0.21 | 0.8 |

| Total public sector | 26.87 | 26.93 | 27.72 | 28.31 | 28.68 | 29.80 | 29.41 | -0.39 | -1.3 | 0.73 | 2.5 |

| Total public sector excluding semi-state bodies | 27.07 | 27.14 | 27.95 | 28.58 | 28.91 | 30.10 | 29.74 | -0.36 | -1.2 | 0.83 | 2.9 |

| Semi-state by sub-sector | |||||||||||

| Non Commercial Semi-state bodies | 27.88 | 27.28 | 27.72 | 27.85 | 28.56 | 29.36 | 29.46 | 0.10 | 0.3 | 0.90 | 3.2 |

| Commercial Semi-state bodies | 25.08 | 25.29 | 26.02 | 26.46 | 26.98 | 27.49 | 26.91 | -0.58 | -2.1 | -0.07 | -0.3 |

| ¹ To calculate average hourly irregular earnings subtract values in Table 8d from Table 8b. | |||||||||||

| * Preliminary Estimates | |||||||||||

| Table 8e Public sector employment by sub-sector and quarter | |||||||||

| Public sector sub-sector | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 | Annual change | |

| Q3 | Q3 | Q3 | Q3 | Q3 | Q2 | Q3* | |||

| % | |||||||||

| Civil service | 38,300 | 39,900 | 40,500 | 41,700 | 43,500 | 44,600 | 44,700 | 1,200 | 2.8 |

| Defence | 9,500 | 9,400 | 9,400 | 9,300 | 9,000 | 8,900 | 8,800 | -200 | -2.2 |

| Garda Siochana | 12,700 | 13,000 | 13,700 | 14,200 | 14,500 | 14,700 | 14,700 | 200 | 1.4 |

| Education | 108,200 | 108,600 | 111,300 | 112,100 | 112,000 | 112,200 | 109,200 | -2,800 | -2.5 |

| Regional bodies | 33,000 | 33,200 | 33,400 | 34,300 | 35,100 | 35,000 | 35,200 | 100 | 0.3 |

| Health | 121,900 | 125,600 | 129,700 | 133,300 | 137,100 | 127,600 | 138,800 | 1,700 | 1.2 |

| Semi-state | 52,700 | 53,100 | 54,400 | 54,900 | 56,400 | 56,200 | 56,300 | -100 | -0.2 |

| Total public sector | 376,300 | 382,900 | 392,300 | 399,800 | 407,700 | 399,100 | 407,600 | -100 | -0.0 |

| Total public sector excluding semi- state bodies | 323,600 | 329,800 | 337,900 | 344,900 | 351,300 | 342,900 | 351,300 | - | - |

| Semi-state by sub-sector | |||||||||

| Non Commercial Semi-state bodies | 12,400 | 12,500 | 12,900 | 13,900 | 14,500 | 14,800 | 14,900 | 400 | 2.8 |

| Commercial Semi-state bodies | 40,300 | 40,600 | 41,500 | 41,100 | 41,900 | 41,400 | 41,400 | -500 | -1.2 |

| ¹ Source: Earnings, Hours and Employment Costs Survey. Public Sector employment includes all those who received a payment which would include both full-time and part-time employees as well as contract workers. Total public sector numbers are also published by the Department of Public Expenditure and Reform on a quarterly basis. Those differ in coverage from the estimates in the above table as Department of Public Expenditure and Reform estimates are based on full-time equivalents which will change over time based on both changes in working hours and number of persons employed. | |||||||||

| * Preliminary Estimates | |||||||||

| Table A1 Estimates of average weekly earnings by broad occupational categories1 | ||||||

| Occupation by NACE groups | 2018 | 2019 | 2020 | 2020 | Quarterly change | Annual change |

| Q2 | Q2 | Q1 | Q2 | |||

| € | € | € | € | % | % | |

| Managers, professionals and associated professionals | ||||||

| B-E | 1,545.87 | 1,590.14 | 1,570.56 | 1,594.24 | 1.5 | 0.3 |

| B-N, R-S | 1,354.01 | 1,403.84 | 1,422.33 | 1,418.11 | -0.3 | 1.0 |

| O-Q | 1,205.98 | 1,228.59 | 1,242.26 | 1,279.12 | 3.0 | 4.1 |

| Total (B-S) | 1,263.89 | 1,297.89 | 1,312.82 | 1,331.22 | 1.4 | 2.6 |

| Clerical, sales and service employees | ||||||

| B-E | 792.88 | 821.77 | 835.42 | 811.28 | -2.9 | -1.3 |

| B-N, R-S | 496.83 | 514.17 | 528.18 | 551.30 | 4.4 | 7.2 |

| O-Q | 573.66 | 571.86 | 583.66 | 593.55 | 1.7 | 3.8 |

| Total (B-S) | 507.90 | 519.01 | 532.80 | 555.40 | 4.2 | 7.0 |

| Production, transport, craft and other manual workers | ||||||

| B-E | 751.78 | 763.48 | 759.77 | 723.65 | -4.8 | -5.2 |

| B-N, R-S | 559.31 | 582.38 | 589.78 | 590.07 | 0.0 | 1.3 |

| O-Q | 479.20 | 493.36 | 504.45 | 501.09 | -0.7 | 1.6 |

| Total (B-S) | 534.84 | 556.13 | 562.87 | 561.28 | -0.3 | 0.9 |

| 1 These estimates have been generated using a sub sample of EHECS respondents therefore caution is advised when interpreting these results. See background notes. | ||||||

| Table A2 Response rates in selected sectors by quarter1 | |||||||||||

| Employer Response Rate % | Respondent Enterprises | Respondent Enterprises | Employee Response Rate % | ||||||||

| NACE Principal Activity | Final Q2 2019 | Preliminary Q2 2020 | Final Q2 2020 | Preliminary Q3 2020 | Final Q2 2020 | Preliminary Q3 2020 | Final Q2 2019 | Preliminary Q2 2020 | Final Q2 2020 | Preliminary Q3 2020 | |

| B-E | Industry | 62.0 | 41.8 | 55.3 | 44.2 | 691 | 544 | 81.9 | 60.9 | 75.1 | 62.8 |

| F | Construction | 44.4 | 23.6 | 40.6 | 29.8 | 156 | 120 | 61.6 | 26.3 | 49.8 | 34.0 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 60.0 | 39.3 | 54.2 | 41.6 | 747 | 580 | 83.2 | 59.4 | 71.8 | 54.7 |

| H | Transportation and storage | 50.0 | 33.8 | 50.3 | 39.1 | 152 | 117 | 68.8 | 51.6 | 72.9 | 61.0 |

| I | Accommodation and food services | 54.6 | 31.7 | 45.3 | 38.2 | 412 | 341 | 70.4 | 36.9 | 54.1 | 40.7 |

| J | Information and communication | 69.9 | 49.3 | 62.9 | 53.0 | 270 | 229 | 84.8 | 68.3 | 80.5 | 71.9 |

| K-L | Financial, insurance and real estate | 75.5 | 54.4 | 68.1 | 57.8 | 256 | 219 | 89.7 | 78.5 | 89.6 | 82.9 |

| M | Professional, scientific and technical activities | 67.5 | 46.4 | 58.7 | 50.1 | 308 | 269 | 83.9 | 63.9 | 77.5 | 70.1 |

| N | Administrative and support service activities | 60.0 | 36.5 | 53.5 | 41.6 | 293 | 226 | 77.2 | 50.0 | 72.0 | 61.5 |

| O | Public administration and defence | 93.7 | 77.8 | 85.6 | 80.9 | 131 | 123 | 99.5 | 86.9 | 88.6 | 87.4 |

| P | Education | 75.0 | 53.5 | 69.7 | 50.4 | 159 | 116 | 97.7 | 88.4 | 91.8 | 83.5 |

| Q | Human health and social work | 76.2 | 52.4 | 65.7 | 55.2 | 496 | 413 | 86.3 | 70.0 | 80.0 | 69.3 |

| R-S | Arts, entertainment, recreation and other service activities | 68.1 | 41.8 | 55.6 | 48.9 | 222 | 199 | 86.0 | 54.3 | 70.5 | 54.4 |

| Total | 63.5 | 42.0 | 56.2 | 45.7 | 4,293 | 3,496 | 84.4 | 65.9 | 77.7 | 67.8 | |

| 1 This table presents the response rates achieved by sector. Greater caution should be taken in the interpretation of estimates for sectors with lower response rates as these sectors could be subject to greater revisions if response levels are increased for final estimates. | |||||||||||

| Table A3 Preliminary data versus final data1 | ||||||||||

| Preliminary Q2 2020 | Final Q2 2020 | Percentage Change | ||||||||

| NACE Principal Activity | Average weekly earnings | Average hourly earnings | Average weekly hours | Average weekly earnings | Average hourly earnings | Average weekly hours | Average weekly earnings | Average hourly earnings | Average weekly hours | |

| B-E | Industry | 911.45 | 25.17 | 36.2 | 900.64 | 24.76 | 36.4 | -1.2 | -1.6 | 0.6 |

| F | Construction | 760.28 | 20.87 | 36.4 | 769.12 | 21.08 | 36.5 | 1.2 | 1.0 | 0.3 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 593.82 | 19.93 | 29.8 | 600.41 | 19.95 | 30.1 | 1.1 | 0.1 | 1.0 |

| H | Transportation and storage | 850.85 | 24.13 | 35.3 | 807.64 | 22.90 | 35.3 | -5.1 | -5.1 | - |

| I | Accommodation and food services | 405.20 | 15.34 | 26.4 | 406.41 | 15.70 | 25.9 | 0.3 | 2.3 | -1.9 |

| J | Information and communication | 1,251.03 | 34.31 | 36.5 | 1,267.26 | 34.28 | 37.0 | 1.3 | -0.1 | 1.4 |

| K-L | Financial, insurance and real estate | 1,168.41 | 34.41 | 34.0 | 1,162.28 | 33.75 | 34.4 | -0.5 | -1.9 | 1.2 |

| M | Professional, scientific and technical activities | 917.77 | 27.08 | 33.9 | 921.64 | 27.15 | 33.9 | 0.4 | 0.3 | - |

| N | Administrative and support service | 621.13 | 20.58 | 30.2 | 610.42 | 20.13 | 30.3 | -1.7 | -2.2 | 0.3 |

| O | Public administration and defence | 975.03 | 26.53 | 36.8 | 998.27 | 27.04 | 36.9 | 2.4 | 1.9 | 0.3 |

| P | Education | 884.68 | 36.86 | 24.0 | 886.39 | 36.50 | 24.3 | 0.2 | -1.0 | 1.2 |

| Q | Human health and social work | 763.52 | 24.12 | 31.7 | 763.16 | 24.05 | 31.7 | -0.0 | -0.3 | - |

| R-S | Arts, entertainment, recreation and other service activities | 561.56 | 20.42 | 27.5 | 582.46 | 19.92 | 29.2 | 3.7 | -2.4 | 6.2 |

| Total | 819.13 | 25.57 | 32.0 | 817.55 | 25.39 | 32.2 | -0.2 | -0.7 | 0.6 | |

| Public/Private Sector | ||||||||||

| Private sector | 756.39 | 23.71 | 31.9 | 753.43 | 23.46 | 32.1 | -0.4 | -1.1 | 0.6 | |

| Public sector | 1,002.67 | 30.93 | 32.4 | 1,008.76 | 31.04 | 32.5 | 0.6 | 0.4 | 0.3 | |

| Size of Enterprise | ||||||||||

| Less than 50 employees | 642.87 | 21.08 | 30.5 | 647.17 | 21.04 | 30.8 | 0.7 | -0.2 | 1.0 | |

| 50-250 employees | 745.95 | 23.38 | 31.9 | 740.76 | 23.23 | 31.9 | -0.7 | -0.6 | - | |

| Greater than 250 employees | 940.71 | 28.58 | 32.9 | 936.19 | 28.28 | 33.1 | -0.5 | -1.0 | 0.6 | |

| 1 See background notes. | ||||||||||

Introduction

The Earnings, Hours and Employment Costs Survey (EHECS) is a survey that collects earnings, labour cost, hours and employment data from enterprises each quarter. The EHECS survey provides the basis for the production of earnings and labour costs statistics, which measures the cost pressure arising from the production factor "labour" and provide a detailed picture of the level, structure and short-term development of labour costs in the different sectors of economic activity in Ireland.

The EHECS survey replaced the four-yearly Labour Costs Survey, and also replaced all other CSO short-term earnings inquiries. The EHECS results are comparable across sectors and include more detail on components of earnings and labour costs than was previously available.

Legislation

The survey information is collected by the Central Statistics Office (CSO) under the S.I. No 115 of 2018 Statistics (Labour Costs Survey) Order 2018. The information collected is treated as strictly confidential in accordance with the Statistics Act 1993. The survey results meet the requirements for Labour Costs statistics set out in Council Regulation (EC) 530/1999.

Business Register

The CSO’s Business Register provides the register of relevant enterprises for the survey. An enterprise is defined as the smallest legally independent unit.

Business Classification

The business classification used for the EHECS is based on the Statistical Classification of Economic Activities in the European Community (NACE Rev.2). The NACE code of each enterprise included in the survey was determined from the predominant activity of the enterprise, based on information provided in this or other CSO inquiries.

Nace Classification

NACE Rev.2 is the latest classification system for economic activities, updated from NACE Rev 1.1. A major revision of NACE was conducted between 2000 and 2007, in order to ensure that the NACE classification system remained relevant for the economy. The main changes that affected the release were the reclassification of some industrial enterprises from industry to services (principally in the software and publishing sectors) and the inclusion of air conditioning supply, sewerage, water management and remediation activities in industry. See web link to NACE coder.

http://www.cso.ie/px/u/NACECoder/NACE Items/search nace.asp

Coverage

The survey results relate to enterprises in the Nace Rev 2 Sections B–E (Industry), F (Construction), G (Wholesale & retail trade: repair of motor vehicles & motorcycles), H (Transportation & storage), I (Accommodation & food services activities), J (Information & communication), K-L (Financial, insurance & real estate activities), M (Professional, scientific & technical activities), N (Administrative & support services activities), O (Public administration & defence), P (Education), Q (Human health & social work activities) and R-S (Arts, entertainment, recreation & other service activities) with 3 or more employees. The data was collected at the enterprise level.

NACE Rev.2 Sections A (Agriculture, forestry and fishing), T (Activities of households as employers) and U (Activities of extraterritorial organisations and bodies) are not covered in the survey as most employment in these sectors is not enterprise based.

All enterprises with 50 or more employees and a sample of those with 3 to 49 employees are surveyed each quarter. The sample is based on the proportion of companies in each NACE 2 digit economic sectors in the 3 to 49 size classes (3 to 9, 10 to 19 and 20 to 49).

Earnings in the public sector are calculated before the deduction of the pension levy that was introduced in March 2009.

Quarters 1 and 2 of 2011 and 2016 include temporary Census field staff in all outputs. Due to the large numbers involved a table is published which illustrates the effects of the field staff on earnings, hours and employment.

Data Collection

The survey is conducted by post and questionnaires are issued in the last week of the relevant quarter. Some returns are received electronically. All returns are scrutinised for accuracy. Where appropriate, firms are queried by telephone, email or post regarding incompleteness, apparent inconsistencies, etc. Information about the survey is on the CSO website and all questionnaires and instructions are available electronically there.

Differences with discontinued sources

The EHECS is not directly comparable with other discontinued short-term earnings surveys such as the Quarterly Industrial Inquiry (QII), the Quarterly Services Inquiry (QSI) and the Quarterly Earnings and Hours worked in Construction (QEC). The main differences are:

The EHECS collects data on the entire reference quarter while the QII, QSI and QEC only collected data for a reference week in the quarter.

Registered Employment:

Registered employment refers to the employment of respondent enterprises at the end of the reference quarter. For non-respondent enterprises and enterprises not in the sample, registered employment refers to the employment from the Business Register. The Business Register base enterprise employment on data from the latest revenue P35 files. The Business Register has a lag of between 12 and 18 months between the current quarter and the latest revenue P35 file. For this reason the Business Register is not a suitable measure of short term trends in employment. Thus, sectoral registered employment is adjusted to reflect the trends of the Labour Force Survey (LFS) sectoral employment. The LFS is designed to measure short term changes in employment.

Average Employment

For respondent enterprises average employment refers to the average of the quarters opening employment and closing employment. This variable is used as the denominator in calculating average earnings per person and average paid hours per person.

All Employees

All persons who have a direct employment contract with an enterprise as employees, who receive wages or salaries. Persons not working for salary e.g. family members, directors, partners, outside pieceworker’s, etc. are not considered employees but other persons engaged. These workers are included separately but not used in the calculation of derived variables. All employment figures are rounded to the nearest hundred.

Full-time Employees

Employees whose regular working hours are the same as the collectively agreed or customary hours worked in the enterprise, irrespective of the duration of the employment contract. Full-time employment often comes with benefits that are not typically offered to part-time, temporary, or flexible workers, such as annual leave, sick leave, and health insurance.

Part-time Employees

Employees whose regular working hours are less than the collectively agreed or customary hours worked in the enterprise. The definition of part-time varies from enterprise to enterprise but in general part-time employees work 80% or less of the regular hours of the enterprise.

Apprentices/Trainees

All persons, both full-time or part-time, whose wages or salaries are governed by the fact that they work either under an apprenticeship contract or as part of a training program.

Category of employees by occupation

For some enterprises information was collected separately for three occupational groups. The three groups are:

1. Managers, Administrators, Professionals and Associate Professionals.

2. Clerical, Sales and Service workers.

3. Production, Transport workers, Craft & Tradespersons and other Manual workers.

Wages and Salaries

All wages and salaries payments are gross (i.e. before deduction of income tax and employees’ PRSI contributions and levies such as the public sector pension levy). In the analysis, the total wages and salaries are divided into:

- Regular earnings: payments made regularly at each pay period during the year, excluding all irregular and overtime earnings.

- Overtime earnings: payment for hours worked in excess of normal hours.

- Total earnings excluding irregular earnings: regular earnings + overtime earnings.

- Irregular earnings: bonuses which are not paid regularly at each pay period. For example: end of quarter or year productivity bonus.

- Apprentices/Trainees earnings: total of apprentices & trainees' regular wages and salaries, overtime and irregular bonuses and allowances.

- Total earnings: total of regular earnings, overtime earnings and irregular earnings.

Other Labour Costs

Other labour costs are costs to the employer, in addition to wages and salaries, of employing labour. They include the below categories:

- Statutory social contributions: statutory employers’ PRSI including the social security contributions for apprentices/trainees.

- Non-statutory social contributions: payments made by enterprises on behalf of their employees which include pension fund contributions, life assurance premiums, income continuance insurance as well as other employee related payments.

- Other expenses: other employee related payments e.g. study grants, etc.

- Benefits in kind (BIK); net cost of all goods and services made available to employees by the employer. For example, payments for private use of company cars, stock options & share purchase schemes, voluntary sickness insurance, staff housing and other free or subsidised benefits (e.g. canteen facilities, childcare provision, health costs). BIK is included as earnings by Eurostat for the Labour Costs Survey and the Labour Costs Index.

- Redundancy payments.

- Subsidies and refunds: amounts received by enterprises intended to refund part or all of the cost of wages and salaries and training costs. These may include training subsidies from SOLAS or Job Bridge as well as refunds from the Department of Employment Affairs and Social Protection (DEASP) for sick and maternity leave. These are deducted from the firms’ labour costs in the analysis.

Paid Hours

- Regular paid hours: These are normal working hours of employees, usually specified in the contract of employment and should include paid leave e.g. paid sick leave and annual leave.

- Overtime paid hours: Hours worked in excess of contracted hours.

- Total paid hours: Sum of regular paid hours and overtime paid hours.

Job Vacancies

Respondents are asked to provide the number of job vacancies in their firm as at the last working day of the quarter. A job vacancy is defined as a newly created post, an unoccupied post or post about to become vacant in the near future, where the employer is actively looking for (i.e. advertising, contacting employment agencies, etc.) and willing to recruit a suitable candidate immediately or very soon. The posts must be open to external candidates, although it may be filled by an internal candidate. Due to one off recruitments by individual firms and a low number of firms reporting vacancies, the job vacancies series can be volatile and should be interpreted with caution. Job vacancy information is collected by the Central Statistics Office under EU regulation (EC) No. 453/2008. For more information on job vacancies please see the link below.

http://ec.europa.eu/eurostat/web/labour-market/job-vacancies

Job Vacancy Rate

The job vacancy rate (JVR) measures the proportion of total posts that are vacant, according to the definition of job vacancy above, expressed as a percentage as follows

Job Vacancy Rate = ( Number of job vacancies / Number of occupied jobs + Number of job vacancies ) * 100

National Minimum Wage (NMW)

The National Minimum Wage Act 2000 became law on the 1st April 2000. Enterprises are asked to indicate the number of employees in receipt of the NMW at the end of each quarter. A detailed guide to the Act is available from the Department of Jobs, Enterprise and Innovation at www.djei.ie. Employees earning less than the minimum wage due to age or training status are also included. These rates do not apply to close relatives of the employer or apprentices other than apprentice hairdressers.

Employment

The sum of full-time employees and part-time employees on the last day of the quarter plus the average number of apprentices engaged during the quarter.

Average Weekly Earnings

Total earnings for the quarter divided by the average number of persons employed during the quarter divided by 13 (number of weeks in a quarter).

Average Hourly Earnings

The sum of regular earnings, irregular earnings, and overtime earnings for the quarter divided by total paid hours for the quarter.

Average Hourly Irregular Earnings

Total irregular earnings in the quarter divided by total paid hours for the quarter.

Average Weekly Paid Hours

Total paid hours for the quarter divided by the average number of persons employed during the quarter divided by 13 (number of weeks in a quarter). Unpaid hours worked (including unpaid overtime) and unpaid leave are excluded.

Average Hourly Other Labour Costs

The sum of other labour costs divided by total paid hours for the quarter. Other labour costs include redundancy payments, employers’ contributions to social security, other social costs, benefit in kind and other labour costs. Subsidies and refunds received were deducted.

Average Hourly Total Labour Costs

Hourly labour costs are total labour costs divided by the total number of hours paid during the quarter.

Annual Data

Annualised results are available as a separate release, details of which are available on the CSO website.

Earnings and Labour Costs Annual Data 2018

Production of EHECS Data

All enterprises with 50 or more employees are surveyed quarterly as well as a sample of enterprises which have between 3 and 49 employees inclusive. For enterprises with 3 to 49 employees inclusive, a weighting factor (the reciprocal of the sampling fraction) is used to weight the estimates to the total population for both employees and enterprises. The CSO's Business Register forms the basis of the sampling frame used for weighting the sample data to the population. Decay factors are calculated for each size class and sector to adjust the non-sampled element of the register for the respondent non-relevant enterprises.

Imputation is carried out for non-respondents in the greater than 50 employees’ categories. Where an enterprise responded in the previous quarter ratio-imputation is used to estimate figures for the current quarter. For enterprises that did not respond in the previous four quarters a stratum average imputation method is used to estimate the missing variables. These estimates are based on respondent enterprises of a similar size and activity.

After imputation, all enterprises with 50 or more employees are accounted for and included in the final dataset. All enterprises employing between 3 and 49 employees are allocated grossing factors to represent the entire population for their relevant industry sector and size class in the quarter. All enterprises' data are contained in the final quarterly dataset which is tabulated to produce the aggregates which are published in the Earnings and Labour Costs quarterly release.

Interpretation of Results

The series presented in this release and all estimates deriving from the EHECS survey are primarily of use as an indicator of trends in average earnings across different classifications. However, in interpreting the trends and in undertaking direct comparison of the average level of earnings across sectors, some caution in interpretation is warranted. For example, the results presented here are based on raw earnings levels. To get a true picture of differences in earnings levels of different employees, comparisons should take account of differences in the characteristics of employees, such as length of service, educational attainment level, nature of work, etc., none of which are available via EHECS. The additional information available from the National Employment Survey (NES) allows for a more detailed analysis of differences in earnings levels and should be referred to by users seeking more detailed information on earnings determinants than is available from EHECS.

It should be noted that all earnings are gross amounts before deductions for PRSI, tax and other levies. This is particularly relevant to the public sector since March 2009 when the pension levy was introduced.