Pulse Survey now running Five years on, we're measuring the lasting impact of COVID-19 on our lives in our latest short Pulse Survey. CSO Pulse Surveys are anonymous and open to all. #CSOTakePart

This publication was produced by the Central Statistics Office in order to provide more information to the user regarding the impact which Foreign Direct Investment (FDI) has in Ireland. The data in this publication was sourced via International Accounts Survey data, Business Register data, and administrative data such as the P35L and the Census Analysis data set.

In this publication, the directional method of presenting FDI is predominantly used apart from the chapters on Greenfield and Pass Through which require the asset and liability method. The differences in the two methods is explained in this note. The directional method separates the data into Inward and Outward FDI. The directional method also nets out reverse investment, for example, the amount a direct investment enterprise in Ireland may give in a loan back to its parent in a foreign country is netted from the direct investment enterprise's inward FDI for the period in which these transactions occur.

This section makes use of published FDI data to impute a return on FDI. The return on FDI is defined as:

| r in, t = | FDI income debitst |

|

| Inward FDI positions | ||

| r in, t = | FDI income creditst |

|

| Outward FDI positions | ||

This definition differs slightly from the definition offered in the OECD Benchmark Definition of Foreign Direct Investment, 4th Edition (BMD4) in that it includes debt income as part of FDI income. This departure from the prescribed definition was made in order to ensure confidentiality protection. In addition, the income on debt is small relative to the income on equity, only marginally affecting the returns.

This publication presents employment data in multiple chapters based on administrative data sources, namely the Revenue Commissioners' P35L dataset of employment and an internal pseudonymised Census 2016 dataset. Before using personal administrative data for statistical purposes, the CSO removes all identifying personal information including the PPSN. The Personal Public Service Number (PPSN) is a unique number that enables individuals to access social welfare benefits, personal taxation and other public services in Ireland. The CSO removes the PPSN and creates a pseudonymised Protected Identifier Key (PIK). The PIK is a unique and non-identifiable number which is internal to the CSO. Using the PIK enables the CSO to link and analyse data for statistical purposes, while protecting the security and confidentiality of the individual data. All records in the matched datasets are pseudonymised and the results are in the form of statistical aggregates which do not identify any individuals.

Employment, for the purposes of this section is defined as the number of full-time equivalents during a given year. Where full-time equivalents consists of full-time and part-time workers. In order to mitigate the distorting affect which counting a temporary wage as an annual salary would have, a number of temporary employees are included as one employee (where their cumulative weeks of insurance amounted to a full year). This procedure is completed by getting employment aggregates, summing their weeks worked and then dividing the weeks worked figure by 52 (to approximate the full-time equivalent number of total employees).

This data is sourced from administrative data (employer-level p35 returns, pseudonymised census) of employed individuals in the Irish economy, which is subsequently matched to employer-level enterprise identifiers. The location of ultimate ownership, or of the Ultimate Controlling Parent, is then sourced from the Balance of Payments database and Business Register surveys, in order to assign enterprise level variables such as ownership location and NACE Rev.2 classification to be added to the employing affiliates. This definition differs conceptually from the presentation of the Return on FDI statistics, which are presented on an Immediate Partner Country basis.

The Revenue Commissioners' P35L file contains a complete register of all employments and is the most accurate source of remuneration. It provides details of gross pay and number of weeks worked in the year for all employments. The annual P35 data is based on the number of all jobs held by employees during the year. Before using personal administrative data for statistical purposes, the CSO removes all identifying personal information including the PPSN. The Personal Public Service Number (PPSN) is a unique number that enables individuals to access social welfare benefits, personal taxation and other public services in Ireland. The CSO converts the PPSN to a Protected Identifier Key (PIK). PRSI classes K and M (associated with pensions) were removed for the purposes of this analysis.

The COPA is a pseudonymised copy of the Census of Population 2016 dataset held internally within the CSO for analysis purposes. It contains Census attribute information for individuals and households of which 95% of records have a PIK which allows them to be linked to pseudonymised administrative data sources to create new analysis. The Census data was used in order to obtain educational attainment levels, country of nationality, and county address data for employees working for FDI associated firms. All the data presented in this publication is aggregated so no individuals may be identified.

Just as in the section 'FDI Associated Employment', the P35 data file is also used in the section on the average wage in Foreign Direct Investment Enterprises. Average wages are defined as follows for sector i:

|

Ӯi = |

Total pay for all employees insured in sector i Total number of employee insured weeks in sector i |

and for a group of subsidiaries controlled from one country j:

|

Ӯj = |

Total pay for all insured employees in enterprises controlled from country j Total number employee insured weeks in those enterprises |

Employees are therefore comprised of all types of workers (full-time, part-time, permanent, temporary etc). It is important to note therefore that this average wage metric should not be deemed to be indicative of the average remuneration for a full-time employee working for the whole year. Instead, it is intended to show the wage differential between sectors and countries who employ individuals through foreign-owned affiliates in Ireland.

In this research publication employees earning less than €500 per annum and employments where the duration was less than two weeks in the year were excluded from the wage statistics. Also excluded from the wage statistics were secondary employments earning less than €4,000 per annum, extremely high earnings values and missing employer and employee reference numbers. These exclusions are in line with the CSO’s Earnings Analysis methodology which similarly looks at Revenue’s P35L data.

Firms described as domestic or Irish are those which have ultimate ownership in Ireland i.e. the majority stake of the parent company is owned by Irish investor(s).

FDI firms or multinational enterprises (MNEs) refer to firms which have ultimate ownership outside of Ireland.

Irish MNEs, where mentioned, refer to Irish firms which have large scale operations in other countries or rely heavily on export markets while having ultimate ownership in Ireland.

The method for defining greenfield in balance of payments data has moved away from the FDI positions method used in previous publications to an FDI transactions approach as proposed by Eurostat. This new approach encompasses both a narrow and a broad definition of greenfield. The separation of narrow and broad greenfield refers to a methodological distinction: Narrow greenfield is FDI equity transactions in enterprises that are no more than three years old and broad greenfield is narrow greenfield plus any follow-up direct investment transactions in existing foreign direct enterprises that are used to acquire capital assets.

A special purpose entity (SPE) is a firm established for reasons that fall outside the production of goods and services. They are often created for accounting or financial purposes. For this publication, we have taken on the most up to date definition of an SPE from the IMF Taskforce: no more than five employees, very little production in the resident economy, non-domestic ultimate controlling parent, and the majority of their balance sheet is foreign assets and liabilities.

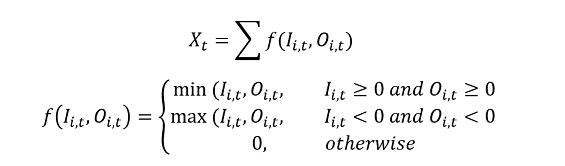

The method used to estimate pass-through FDI involves comparing a firm’s FDI assets and liabilities. The lower of these figures is then chosen and used as the estimate of pass-through FDI for that particular enterprise. In the instance of negative FDI assets and liabilities for a firm, the greater of the two figures is then chosen as the estimate for pass-through. If a firm has negative FDI assets and positive FDI liabilities (or vice-versa), an estimate for pass-through cannot be reasonably established. In these cases, pass-through is set to zero. The results are then aggregated to give an overall estimate of pass-through FDI in Ireland. Shown formally, the method is as follows:

where Ii,t denotes inward FDI position of an enterprise and 0i,t is the outward FDI position.

Ultimate Controlling Parent

The enterprise at the top of the ownership chain i.e. not controlled by any other entity. The geographical location of the ultimate source of control of the stocks of inward FDI for a reporting economy is used in this publication to present inward FDI, employment and average wages by ultimate ownership of the foreign affiliate.

Immediate Parent

The parent influencing or directly controlling a direct investment enterprise. This presentation is used to present the return on FDI in chapter two of this publication.

The economic sector classification used in this publication is based on the ‘Statistical Classification of Economic Activities in the European Community (NACE Rev.2)’which can be accessed on the Eurostat website. The NACE code of each enterprise included in the survey was determined from the predominant activity of the enterprise, based on information provided to the CSO.

Affiliated Enterprises

Affiliated enterprises are enterprises in a direct investment relationship. Thus, a given direct investor, its direct investors, its subsidiaries, its associates, and its branches, including all fellow enterprises, are affiliated enterprises. It is possible for a given enterprise to be a member of two or more groups of affiliated enterprises.

References

Final Report of the Task Force on Special Purpose Entities, Washington, D.C., 2018 (PDF)

Blanchard, Olivier & Acalin, Julien (2016) “What does Measured FDI Actually Measure?”, Peterson Institute for International Economics

Leino, Topias & Ali-Yrkko, Jyrki (2014) “How Well Does Foreign Direct Investment Measure Real Investment by Foreign-Owned Companies? – Firm-Level Analysis”, Bank of Finland Research Discussion Papers, vol. 12

Statistical Release, CBS Netherlands (2018)

Eurostat (2019), Balance of Payments Working Group, 2-3 Dec 2019

Sixth Edition of the IMF's Balance of Payments and International Investment Position Manual (BPM6)

Next Chapter >> Contact Details

Learn about our data and confidentiality safeguards, and the steps we take to produce statistics that can be trusted by all.