This publication presents statistics on earnings based on administrative data sources. The primary data source is employee tax data from the Revenue Commissioners, and social transfer data from the Department of Social Protection which is linked to data from the CSO and other sources to provide demographic breakdowns of earnings.

Revenue's employee tax data contains a complete register of all employments and is the most accurate source of remuneration. It provides details of gross annual earnings and number of weeks worked in the year for all employments. The weekly earnings are calculated by dividing the gross annual earnings, as declared to Revenue, by the number of weeks worked in the year for each employment.

For years 2011-2018 the employee tax data used for the probation publication came from employer end of year returns, P35, submitted to Revenue. The P35 was an annual return that was completed by all registered employers after the tax year end, up to 2018.

Since 1 January 2019, Revenue have operated real-time reporting of payroll, “PAYE Modernisation" (PMOD). Employers are required to report their employees’ pay and deductions in real-time to Revenue each time they operate payroll. Information is provided to Revenue at individual payslip level. Earnings Analysis using Administrative Data Sources for 2019 and 2020 is based on the more detailed employee tax data provided from Revenue’s PMOD system.

The Central Records System of the Department of Social Protection provides information on age, nationality, gender, and county of residence. Using a unique identifier (see 'Methodology' below) each employee on the employee tax data files can be linked to their individual demographic characteristics on the Department of Social Protection datasets. Therefore, the earnings dataset is enhanced by adding the demographic details.

The Irish Probation Service provide annual data of individuals who have served probation orders to the Central Statistics Office to publish statistics related to re-offending. The information includes the personal identity characteristics (name, age, address, etc.) and the justice related characteristics (offence type, release date).

Before using personal administrative data for statistical purposes, the CSO removes all identifying personal information including the Personal Public Service Number (PPSN). The PPSN is a unique number that enables individuals to access social welfare benefits, personal taxation and other public services in Ireland. The CSO converts the PPSN to a Protected Identifier Key (PIK). The PIK is a unique and non-identifiable number which is internal to the CSO. Using the PIK enables the CSO to link and analyse data for statistical purposes, while protecting the security and confidentiality of the individual data. The Revenue, DSP and CSO records were linked using the PIK for this project. All records in the datasets are anonymised and the results are in the form of statistical aggregates which do not identify any individuals.

The results presented in this release are based on a data-matching exercise of three administrative data sources:

The linkage and analysis was undertaken by the CSO for statistical purposes in line with the Statistics Act, 1993 and the CSO Data Protocol.

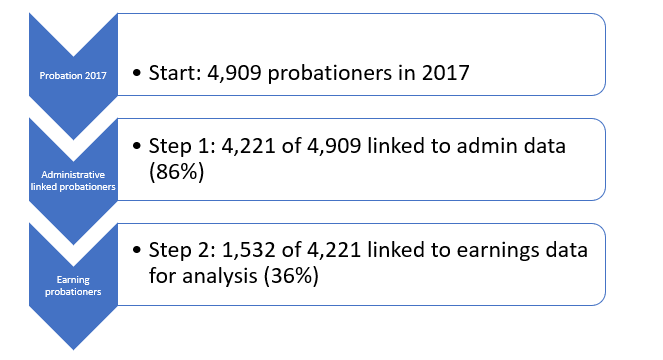

The diagram provides a flow description of the matching process used to link individuals serving probation orders in 2017 to administrative data on earnings provided by the revenue commissioners.

Table 4.1 gives a more detailed breakdown of the number of matches between individuals that received a Probation order in 2017 (4,909) and CSO’s administrative data. On average, 86% of the individuals were linked with a record for each year, although the individuals matched between years were not always the same person. See Table 4.1.

In total, the 29,651 matches between individuals on probation in 2017 (from Table 4.1) linked to 10,727 employment returns from the revenue commissioners between 2014 to 2017. In a small number of cases more than one employment record was linked to a probationer when they participated in more than one employment within a tax year (e.g., had a 2nd job or changed work during the reference year). In addition, a small number of matches were not matched to the administrative employment data used in the analysis as they fell below the threshold of earnings being used (e.g., the individual earned less than €500 in a year or worked less than 2 weeks). See Table 4.2.

Of the 29,651 references that were linked to the probation cohort from 2017, 10,727 (36%) cases were linked to earnings relating to work as an employee for the purpose of the analysis. See Table 4.2.

In the absence of a unique identifier in use for criminal justice datasets like the Probation Service dataset, matching of records is more difficult and will likely not result, as in the case for this publication, in a 100% match rate. The matching performed for this publication resulted in a significant matching rate (86%) despite the limitations of the exercise given the absence of a unique identifier.

Table 4.3 provides a comparison of the personal characteristics of probationers that were matched successfully compared to the probationers that were not matched to administrative data from the reference year 2019. The comparison shows that the characteristics of the two populations (matched vs unmatched) is reasonably closely related with respect to age and sex indicating that it is less likely that the unmatched population has significantly different characteristics with respect to the earnings analysis.

Overall, 86% of the probationers that were included in the study were successfully linked to CSO’s administrative data. Of this cohort, 36% were linked to employment indicators for the reference period of the study (as not all probationers are labour market active as employees). Table 4.4 provides details of the social transfers for those probationers who are not labour market active as employees. Overall, 97% received some form of social transfer with almost half (49%) of probationers who are not labour market active as employees in receipt of unemployment payments.

For the purposes of this analysis the CSO excluded employees earning less than €500 per annum and employments where the duration was less than two weeks in the year. Also excluded were secondary employments earning less than €4,000 per annum, extremely high earnings values and missing employer and employee reference numbers. Employment activity in NACE sectors A, T, and U has also been excluded from the analysis. Unlike CSO’s current main publication of Earnings Analysis using Administrative Data Sources, this publication includes employments that took place outside of October during the reference year. This exclusion is currently applied to the CSO’s existing publication of administrative earnings in order to comply with Eurostat’s guidelines however the restriction was not applied in the analysis conducted on the probationers in order to include as many of the matched cohort as possible for the analysis. Overall, 36% of the probationers from 2017 were linked to active employments during the reference period from 2014 to 2017. The effects of the exclusion are outlined in the current publication of Earnings Analysis using Administrative Data Sources.

A small proportion of individuals who received probation orders in 2017 were also linked to earnings derived solely from self-employment. Table 4.5 provides a breakdown by year of the number individuals who provided an earnings return from self-employment. Due to the low number of matches of individuals with employments who were also linked to self-employment, this publication does not include any self-employment related earnings analysis.

The sectoral employment figures are based on the EU NACE Rev. 2 (Nomenclature généraledes activités économiques dans les Communauté européenne) classification as defined in Council Regulation (EC) no 1893/2006.

For further information please see the CSO standard classification of NACE.

This report is the 1st of a number of planned reports that will utilise CSO’s access to administrative data in order to provide a statistical profile of individuals linked with the justice system and justice procedures. The reports, which are being developed in consultation with stakeholders will focus on the following areas of social and economic life:

Learn about our data and confidentiality safeguards, and the steps we take to produce statistics that can be trusted by all.