| € million | ||

| 2016 | 2017 | |

| Flows - Abroad | 27,180 | -34,690 |

| Flows - In Ireland | 35,607 | -1,109 |

| Positions - Abroad - end year | 812,639 | 717,133 |

| Positions - In Ireland - end year | 797,521 | 744,386 |

| Positions - Net - end year | 15,118 | -27,253 |

| Net Income Flows | -42,673 | -51,320 |

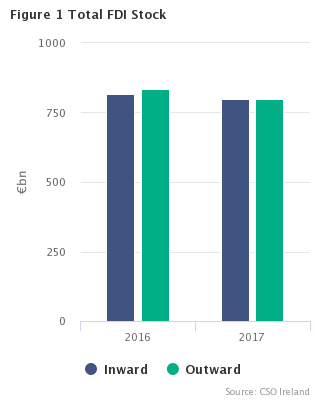

Irish stocks of direct investment abroad decreased to €717bn at the end of 2017 from a stock position of €813bn at the end of 2016. The end 2017 stock of direct investment abroad comprised of Equity Capital & Reinvested Earnings of €646bn and Other Capital of €71bn - see Table 3.

The stock of direct investment in Ireland also decreased between the end of 2016 and the end of 2017 - from €798bn to €744bn - see Table 4.

The decrease in stock of direct investment abroad between the end of 2016 and the end of 2017 - from €813bn to €717bn resulted from the withdrawal of investment from Luxembourg (-€118bn) and Offshore centres (-€12bn) which was partially offset by increased investment in Netherlands (€25bn) and US (€5bn) - see Table 3.

The decrease in stock of direct investment in Ireland between the end of 2016 and the end of 2017 - from €798bn to €744bn was largely due to withdrawals of investment by US (-€45bn) and UK (-€16bn) - see Table 4.

The net FDI for Ireland at the end of 2017 was a deficit of €27bn, down €42bn from the net position at the end of 2016.

| X-axis label | United States | Other | Offshore Centres | Netherlands | Luxembourg | Switzerland |

|---|---|---|---|---|---|---|

| 2017 | 178.992 | 155.526 | 142.977 | 100.013 | 92.402 | 74.476 |

| X-axis label | United States | Ireland | Other | Offshore Centres | United Kingdom | Germany |

|---|---|---|---|---|---|---|

| 2017 | 519.516 | 92.524 | 59.302 | 41.008 | 20.108 | 11.928 |

In line with International recommendations, the geographic allocation of direct investment flows and stocks in Tables 1 to 9 is based on the country of location of the immediate owner of the direct investment enterprise.

An alternative presentation of the stock of direct investment in Ireland by ultimate investor displays a different geographic pattern. Figure 2 presents the value of investment stock in Ireland by location of the immediate owner (of the direct investment enterprise). Figure 3 presents the value of investment stock in Ireland by location of the ultimate investor. In 2017, the stock of investment from the US as ultimate investor at €520bn was €341bn greater than the stock of US investment presented by immediate owner (€179bn). Investment stock from Ireland as ultimate investor at €93bn primarily represents former US-based corporate inversion enterprises which are now located in Ireland (see Figure 3).

Flows of direct investment into Ireland in 2017 decreased from an investment of €36bn in 2016 to a disinvestment of €1bn in 2017. Reinvested earnings inflows of €53bn were offset by the withdrawal of Equity and other capital investment of €36bn and €19bn respectively. Investment from the US decreased further from a withdrawal of €55bn in 2016 to a withdrawal of €60bn in 2017. Investment from Bermuda also decreased from an investment of €6bn in 2016 to a withdrawal of €20bn in 2017- see Table 2.

| X-axis label | Netherlands | Luxembourg | Offshore Centres | United Kingdom | Italy | United States | Other |

|---|---|---|---|---|---|---|---|

| Flows | 29.58 | 23.212 | 18.641 | 2.993 | 2.298 | -60.386 | -17.447 |

Direct investment flows abroad also decreased from an investment of €27bn in 2016 to a withdrawal of investment €35bn in 2017. Direct investment flows abroad of reinvested earnings €17bn and other capital €14bn were offset by a withdrawal of Equity €66bn. The withdrawal of equity investment was mainly from Europe (€69bn) and the US (€7bn) - see Table 1.

| X-axis label | Total | Europe | US |

|---|---|---|---|

| 2012 | 38.046 | 25.113 | 3.757 |

| 2013 | 38.107 | 24.443 | 9.615 |

| 2014 | 36.317 | 19.649 | 6.892 |

| 2015 | 196.363 | 79.976 | 76.457 |

| 2016 | 35.607 | 96.488 | -55.433 |

| 2017 | -1.109 | 76.388 | -60.386 |

Flows of direct investment into Ireland escalated in 2015 to €196bn mainly due to increased investment from Europe (€80bn) and US (€76bn). While investment from Europe remained strong in years 2016 and 2017 with inflows of €96bn and €76bn respectively, US investment significantly decreased with withdrawals of €55bn and €60bn over the same period - see Table 2.

Investment abroad by enterprises located in Ireland was largely from the services sector – an investment position of €616bn at the end of 2017 was down €104bn compared to the position at the end of 2016 (€720bn). Of this investment from the services sector, 73% (€447bn) was into the EU. Investment from the manufacturing sector amounted to €73bn - see Table 7.

The Services Sector remains the largest sector for inward investment - at the end of 2017 the investment position of €469bn was down just €6bn on end year 2016 position (€475bn). Investment in financial intermediation and administrative and support activities decreased from €204bn and €64bn in 2016 to €197 and €59bn in 2017 respectively. Investment in the Manufacturing Sector decreased by €47bn to €274bn in the same period - see Table 8.

| X-axis label | Manufacturing | Services |

|---|---|---|

| In Ireland | 274.215 | 469.122 |

| Abroad | 72.889 | 615.737 |

Income outflows of foreign owned direct investment enterprises were €72bn in 2017, an increase of €11bn compared with 2016. Earnings of European owned companies were €55bn in 2017, up €13bn on the 2016 figure. Income earned abroad by investors located in Ireland was €21bn in 2017, up €2.3bn on 2016. The earnings abroad were mainly from Luxembourg (€10bn), the Netherlands (€5bn), the UK and offshore centres (€2bn & €3bn) - see Table 9.

| Table 1 Direct Investment1 Flows Abroad Classified by Location of Investment | € million | |||||||||

| Region/Country | 2016 2 | 2017 | ||||||||

| Equity | Reinvested Earnings | Other Capital | Total | Equity | Reinvested Earnings | Other Capital | Total | |||

| Europe | 13,932 | 13,399 | -26,797 | 535 | -69,203 | 17,363 | 26,804 | -25,037 | ||

| of which: | ||||||||||

| Belgium | * | * | -656 | -642 | -16 | 29 | 335 | 348 | ||

| France | 240 | 128 | 10 | 378 | * | * | 589 | 1,256 | ||

| Germany | * | * | 176 | -971 | 60 | 138 | -616 | -416 | ||

| Italy | * | * | 174 | -569 | 53 | 6 | 19 | 79 | ||

| Luxembourg | 5,043 | 7,553 | -20,202 | -7,605 | -92,660 | 8,463 | 3,453 | -80,746 | ||

| Netherlands | 4,074 | 2,941 | -2,646 | 4,371 | * | 4,150 | * | 27,986 | ||

| Spain | -67 | 29 | 100 | 61 | 46 | -15 | -216 | -185 | ||

| Switzerland | * | * | -2,813 | -3,061 | * | * | -3,435 | * | ||

| United Kingdom | 10,436 | 411 | 12 | 10,857 | 713 | 1,828 | -704 | 1,836 | ||

| EU 283 | 17,569 | 13,034 | -24,105 | 6,500 | -79,829 | 16,286 | 17,359 | -46,181 | ||

| EMU 194 | 7,160 | 11,294 | -23,167 | -4,713 | -83,103 | 13,249 | 18,309 | -51,544 | ||

| Americas | 25,089 | 2,636 | -9,888 | 17,839 | -14,596 | 3,102 | 6,492 | -5,001 | ||

| North America | 16,089 | 1,181 | -10,106 | 7,163 | -7,028 | 89 | 11,192 | 4,252 | ||

| of which: | ||||||||||

| Canada | -6 | -7 | 119 | 107 | 252 | 12 | 23 | 289 | ||

| United States | 16,095 | 1,187 | -10,227 | 7,056 | -7,281 | 74 | 11,168 | 3,963 | ||

| Central America | * | * | * | 10,343 | * | 2,917 | * | -9,009 | ||

| South America | * | * | * | 332 | * | 99 | * | -245 | ||

| Asia | * | * | -300 | -1,815 | * | * | -892 | -1,598 | ||

| of which: | ||||||||||

| China | * | * | 24 | * | * | * | 0 | * | ||

| Hong Kong | * | -14 | * | -434 | * | -10 | -16 | * | ||

| Japan | * | -46 | * | 387 | * | * | -1,219 | -1,477 | ||

| Africa | * | * | * | * | * | * | 69 | 10 | ||

| Oceania and Polar Regions | 5 | 72 | -393 | -317 | 23 | -9 | 28 | 45 | ||

| Not geographically allocated5 | 1,428 | 370 | * | * | 14,836 | 810 | -18,755 | -3,108 | ||

| Total | 43,782 | 11,774 | -28,377 | 27,180 | -65,888 | 17,450 | 13,749 | -34,690 | ||

| of which: | ||||||||||

| All offshore centre6 | 5,488 | 2,169 | -1,958 | 5,699 | -4,896 | 4,132 | -4,014 | -4,777 | ||

| 1Data are provided according to arithmetic sign conventions e.g. minus signs are used in cases where there is withdrawal of investment. | ||||||||||

| 2Revised. | ||||||||||

| 3For analytical purposes, additional details are given of transactions between residents of Ireland and residents of the EU28 area. | ||||||||||

| 4The relevant EMU countries are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia and Spain. | ||||||||||

| 5This category covers data supplied by respondents without a geographical breakdown. | ||||||||||

| 6This category overlaps with the regions referred to above and covers Andorra, Antigua and Barbuda, Anguilla, Netherlands Antilles, Barbados, Bahrain, Bermuda, Bahamas, Belize, Cook Islands, Curacao, Dominica, Grenada, Guernsey, Gibraltar, Hong Kong, Isle of Man, Jersey, Jamaica, St. Kitts and Nevis, St Maarten, Turks and Caicos Islands, Cayman Islands, Lebanon, Saint Lucia, Liechtenstein, Liberia, Marshall Islands, Montserrat, Maldives, Nauru, Niue, Panama, Philippines, Singapore, Saint Vincent and the Grenadines, British Virgin Islands, US Virgin Islands, Vanuatu, Samoa. | ||||||||||

| *Data suppressed for confidentiality reasons. | ||||||||||

| Table 2 Direct Investment1 Flows into Ireland Classified by Location of Investor | € million | ||||||||

| Region/Country | 2016 2 | 2017 | |||||||

| Equity | Reinvested Earnings | Other Capital | Total | Equity | Reinvested Earnings | Other Capital | Total | ||

| Europe | 69,711 | 28,458 | -1,682 | 96,488 | 25,565 | 46,834 | 3,990 | 76,388 | |

| of which: | |||||||||

| Belgium | * | 1,080 | * | 4,316 | 1,798 | 1,781 | -5,134 | -1,556 | |

| France | -74 | 1,729 | 33 | 1,688 | * | 1,726 | * | -1,864 | |

| Germany | -533 | 689 | 2,389 | 2,544 | -75 | 161 | -850 | -765 | |

| Italy | -607 | 1,411 | 1,282 | 2,086 | * | 2,387 | * | 2,298 | |

| Luxembourg | * | 978 | * | -55,307 | * | 11,547 | * | 23,212 | |

| Netherlands | 13,033 | 7,254 | -13,585 | 6,701 | -452 | 8,014 | 22,017 | 29,580 | |

| United Kingdom | 3,005 | 2,883 | -21,449 | -15,561 | 1,247 | 1,121 | 623 | 2,993 | |

| EU 283 | 15,170 | 16,446 | -57,530 | -25,915 | -2,243 | 27,400 | 29,970 | 55,127 | |

| EMU 194 | 11,801 | 13,486 | -63,023 | -37,734 | -3,418 | 26,143 | 29,681 | 52,407 | |

| North America | * | 1,110 | * | -56,390 | * | 1,187 | * | -62,063 | |

| of which: | |||||||||

| Canada | * | 17 | * | -957 | * | -44 | * | -1,677 | |

| United States | 24,454 | 1,095 | -80,982 | -55,433 | -19,319 | 1,231 | -42,297 | -60,386 | |

| Central America | 3,039 | 6,539 | -3,054 | 6,525 | -20,796 | 3,928 | 20,688 | 3,817 | |

| of which: | |||||||||

| Bermuda | 1,734 | 7,097 | -2,738 | 6,092 | * | 2,944 | * | -20,337 | |

| South America | * | 0 | * | 1 | * | 0 | * | -14 | |

| of which: | |||||||||

| Brazil | 0 | 0 | 155 | 155 | 0 | 0 | 72 | 72 | |

| Asia | 1,216 | 420 | -13,311 | -11,676 | -202 | 881 | -2,093 | -1,415 | |

| of which: | |||||||||

| China | * | * | 1,698 | 1,897 | * | * | 14 | 109 | |

| Japan | * | * | -230 | 530 | * | * | -2,548 | -2,286 | |

| Africa | 31 | 6 | -126 | -87 | -12 | 4 | * | * | |

| Oceania and Polar Regions | -12 | * | -1,160 | * | * | * | 719 | 736 | |

| Not geographically allocated5 | 6 | * | 1,768 | * | * | * | * | * | |

| Total | 97,986 | 36,682 | -99,059 | 35,607 | -35,529 | 53,029 | -18,608 | -1,109 | |

| of which: | |||||||||

| All offshore centres6 | 45,157 | 10,528 | 21,297 | 76,981 | -16,383 | 14,997 | 20,027 | 18,641 | |

| 1Data are provided according to arithmetic sign conventions e.g. minus signs are used in cases where there is withdrawal of investment. | |||||||||

| 2Revised. | |||||||||

| 3For analytical purposes, additional details are given of transactions between residents of Ireland and residents of the EU28 area. | |||||||||

| 4The relevant EMU countries are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia and Spain. | |||||||||

| 5This category covers data supplied by respondents without a geographical breakdown. | |||||||||

| 6This category overlaps with the regions referred to above and covers Andorra, Antigua and Barbuda, Anguilla, Netherlands Antilles, Barbados, Bahrain, Bermuda, Bahamas, Belize, Cook Islands, Curacao, Dominica, Grenada, Guernsey, Gibraltar, Hong Kong, Isle of Man, Jersey, Jamaica, St. Kitts and Nevis, Cayman Islands, Lebanon, Saint Lucia, Liechtenstein, Liberia, Marshall Islands, Montserrat, Maldives, Nauru, Niue, Panama, Philippines, Singapore, St MaartenTurks and Caicos Islands, Saint Vincent and the Grenadines, British Virgin Islands, US Virgin Islands, Vanuatu, Samoa. | |||||||||

| *Data suppressed for confidentiality reasons. | |||||||||

| Table 3 Direct Investment1 Abroad End Year Positions Classified by Location of Investment | € million | ||||||

| Region/Country | 2016 2 | 2017 | |||||

| Equity Capital & Reinvested Earnings | Other Capital | Total | Equity Capital & Reinvested Earnings | Other Capital | Total | ||

| Europe | 521,729 | 76,086 | 597,815 | 425,906 | 90,568 | 516,474 | |

| of which: | |||||||

| France | 2,861 | 289 | 3,149 | 3,527 | 853 | 4,381 | |

| Germany | 3,237 | 297 | 3,534 | 3,272 | -136 | 3,136 | |

| Italy | 603 | -82 | 521 | 605 | -80 | 525 | |

| Luxembourg | 335,119 | 66,373 | 401,492 | 222,686 | 60,815 | 283,500 | |

| Netherlands | * | * | 54,821 | 64,542 | 15,008 | 79,551 | |

| Switzerland | * | * | -17,587 | * | * | -13,177 | |

| United Kingdom | * | * | 94,174 | 74,689 | 13,302 | 87,991 | |

| Offshore centres | 14,621 | 535 | 15,156 | 19,597 | 394 | 19,991 | |

| EU 283 | 500,379 | 97,414 | 597,792 | 394,801 | 101,204 | 496,005 | |

| EMU 194 | 409,806 | 73,871 | 483,677 | 306,875 | 80,817 | 387,693 | |

| Americas | 185,494 | -23,816 | 161,677 | 164,005 | -12,801 | 151,204 | |

| North America | 122,802 | -32,532 | 90,270 | 111,208 | -16,242 | 94,966 | |

| of which: | |||||||

| Canada | 2,064 | 272 | 2,337 | 1,746 | 331 | 2,077 | |

| United States | 120,738 | -32,805 | 87,933 | 109,462 | -16,573 | 92,889 | |

| Central America | * | * | 70,212 | 52,427 | 3,020 | 55,447 | |

| of which: | |||||||

| Offshore centres | 61,696 | 7,784 | 69,481 | 51,703 | 2,864 | 54,567 | |

| South America | * | * | 1,196 | 370 | 420 | 791 | |

| Asia | 17,585 | 2,573 | 20,158 | 15,325 | 772 | 16,096 | |

| Africa | * | * | * | * | * | -111 | |

| Oceania and Polar Regions | 2,229 | * | * | 2,096 | -654 | 1,442 | |

| Not geographically allocated5 | * | 13,969 | * | * | * | 32,029 | |

| Total | 745,116 | 67,523 | 812,639 | 645,662 | 71,471 | 717,133 | |

| of which: | |||||||

| All offshore centres6 | * | * | 90,216 | * | * | 77,733 | |

| 1The sign convention used is: for year-end positions 'Abroad', an entry without sign indicates a net asset position, while a minus sign indicates a net liability position. | |||||||

| 2Revised. | |||||||

| 3For analytical purposes, additional details are given of transactions between residents of Ireland and residents of the EU28 area. | |||||||

| 4The relevant EMU countries are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia and Spain. | |||||||

| 5This category covers data supplied by respondents without a geographical breakdown. | |||||||

| 6This category overlaps with the regions referred to above and covers Andorra, Antigua and Barbuda, Anguilla, Netherlands Antilles, Barbados, Bahrain, Bermuda, Bahamas, Belize, Cook Islands, Curacao, Dominica, Grenada, Guernsey, Gibraltar, Hong Kong, Isle of Man, Jersey, Jamaica, St. Kitts and Nevis, Cayman Islands, Lebanon, Saint Lucia, Liechtenstein, Liberia, Marshall Islands, Montserrat, Maldives, Nauru, Niue, Panama, Philippines, Singapore, St Maarten Turks and Caicos Islands, Saint Vincent and the Grenadines, British Virgin Islands, US Virgin Islands, Vanuatu, Samoa. | |||||||

| *Data suppressed for confidentiality reasons. | |||||||

| Table 4 Direct Investment1 in Ireland End Year Positions Classified by Location of Investor | € million | ||||||

| Region/Country | 2016 2 | 2017 | |||||

| Equity Capital & Reinvested Earnings | Other Capital | Total | Equity Capital & Reinvested Earnings | Other Capital | Total | ||

| Europe | 495,917 | -24,008 | 471,908 | 510,946 | -29,455 | 481,491 | |

| of which: | |||||||

| Belgium | 21,271 | -12,127 | 9,144 | 21,481 | -16,050 | 5,430 | |

| France | 18,359 | 1,098 | 19,457 | 16,310 | -1,209 | 15,101 | |

| Germany | 8,257 | -3,742 | 4,515 | 7,811 | -2,402 | 5,409 | |

| Italy | 7,380 | 415 | 7,795 | 8,073 | 310 | 8,384 | |

| Luxembourg | 138,703 | * | * | 148,652 | -56,250 | 92,402 | |

| Netherlands | 67,780 | 17,261 | 85,042 | 60,875 | 39,138 | 100,013 | |

| Spain | * | * | 7,972 | * | * | 9,215 | |

| Switzerland | 50,923 | 6,623 | 57,546 | 74,037 | 439 | 74,476 | |

| United Kingdom | 70,650 | 3,396 | 74,046 | 70,713 | -12,545 | 58,168 | |

| Offshore centres | * | 726 | * | * | 186 | * | |

| EU 283 | 353,225 | -31,058 | 322,167 | 355,409 | -28,941 | 326,468 | |

| EMU 194 | 276,262 | -58,260 | 218,003 | 279,124 | -37,386 | 241,739 | |

| North America | 88,007 | 137,961 | 225,968 | 78,617 | 100,753 | 179,370 | |

| of which: | |||||||

| Canada | 2,927 | -559 | 2,368 | 1,264 | -886 | 379 | |

| United States | 85,080 | 138,520 | 223,600 | 77,353 | 101,639 | 178,992 | |

| Central America | 87,424 | -20,543 | 66,882 | 67,402 | 3,679 | 71,081 | |

| of which: | |||||||

| Offshore centres | 87,424 | -20,130 | 67,295 | 67,402 | 317 | 67,719 | |

| South America | 0 | -561 | -561 | 0 | -143 | -143 | |

| of which: | |||||||

| Brazil | 0 | -125 | -125 | 0 | -111 | -111 | |

| Asia | * | -4,834 | * | 12,487 | -7,054 | 5,433 | |

| of which: | |||||||

| China | * | 276 | * | * | -217 | * | |

| Japan | 2,364 | 45 | 2,409 | 2,376 | -1,948 | 428 | |

| Singapore | * | * | -4,415 | 384 | -4,441 | -4,058 | |

| Offshore centres5 | 537 | -4,571 | -4,034 | 561 | -4,178 | -3,616 | |

| Africa | 189 | -185 | 4 | * | -48 | * | |

| Oceania and Polar Regions | * | * | -620 | 45 | 375 | 420 | |

| Not geographically allocated6 | * | * | * | * | 4,086 | * | |

| Total | 706,277 | 91,244 | 797,521 | 672,193 | 72,193 | 744,386 | |

| of which: | |||||||

| All offshore centres7 | 176,927 | -23,978 | 152,949 | 146,618 | -3,641 | 142,977 | |

| 1The sign convention used is: for year-end positions 'Abroad', an entry without sign indicates a net liability position, while a minus sign indicates a net asset position. | |||||||

| 2Revised. | |||||||

| 3For analytical purposes, additional details are given of transactions between residents of Ireland and residents of the EU28 area. | |||||||

| 4The relevant EMU countries are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia and Spain. | |||||||

| 5This category overlaps with some of the regions referred to above. | |||||||

| 6This category covers data supplied by respondents without a geographical breakdown. | |||||||

| 7This category overlaps with the regions referred to above and covers Andorra, Antigua and Barbuda, Anguilla, Netherlands Antilles, Barbados, Bahrain, Bermuda, Bahamas, Belize, Cook Islands, Curacao, Dominica, Grenada, Guernsey, Gibraltar, Hong Kong, Isle of Man, Jersey, Jamaica, St. Kitts and Nevis, Cayman Islands, Lebanon, Saint Lucia, Liechtenstein, Liberia, Marshall Islands, Montserrat, Maldives, Nauru, Niue, Panama, Philippines, Singapore, St Maarten Turks and Caicos Islands, Saint Vincent and the Grenadines, British Virgin Islands, US Virgin Islands, Vanuatu, Samoa. | |||||||

| *Data suppressed for confidentiality reasons. | |||||||

| Table 5 Direct Investment1 Flows Abroad Classified by Activity2 of Resident Investor | € million | |||||||

| Sector | NACE 2 | 2016 3 | 2017 | |||||

| Total | of which: | Total | of which: | |||||

| Section & Division | EU 284 | EMU 195 | EU 284 | EMU 195 | ||||

| All Industries | 27,180 | 6,500 | -4,713 | -34,690 | -46,181 | -51,544 | ||

| of which: | ||||||||

| Agriculture, Forestry and Fishing; Mining and Quarrying; Construction | A, B & F | * | * | * | * | * | * | |

| Total Manufacturing Sector | C | 4,295 | 1,565 | 537 | 3,610 | 6,834 | 5,672 | |

| Food, beverages and tobacco products | 10, 11 & 12 | 324 | 456 | * | * | * | * | |

| Textiles and wood | 13, 14 & 16 - 18 | * | 242 | * | * | * | * | |

| Basic pharmaceutical products and preparations | 21 | * | * | * | -2,460 | 298 | 290 | |

| Other manufacturing n.e.s. | * | * | 184 | 5,125 | 7,563 | 6,971 | ||

| Electricity, Gas, Steam and Air Conditioning supply | D | * | * | * | * | * | * | |

| Total Services Sector | 45 - 99 | 21,649 | 2,434 | -7,324 | -41,112 | -53,657 | -58,058 | |

| Wholesale and retail trade; Repairs of motor vehicles | G | 1,742 | * | * | -1,894 | 260 | 142 | |

| Transportation and storage | H | * | * | 0 | * | * | 0 | |

| Information and communication | J | -1,174 | 172 | * | 12,672 | * | * | |

| Financial and insurance activities | K | * | 1,187 | 496 | 8,322 | -187 | 186 | |

| of which: | ||||||||

| Activities of holding companies | 64.2 | -682 | * | * | 2,153 | * | * | |

| Other service activities6 | 7,869 | -197 | -6,497 | * | -64,522 | * | ||

| 1Data are provided according to arithmetic sign conventions e.g. minus signs are used in cases where there is withdrawal of investment. | ||||||||

| 2The activity classification used in this release is the NACE Rev. 2 classification. | ||||||||

| 3Revised. | ||||||||

| 4For analytical purposes, additional details are given of transactions between residents of Ireland and residents of the EU28 area. | ||||||||

| 5The relevant EMU countries are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia and Spain. | ||||||||

| 6This covers residual FDI service activity. | ||||||||

| *Data suppressed for confidentiality reasons. | ||||||||

| Table 6 Direct Investment1 Flows into Ireland Classified by Activity2 of Resident Enterprise | € million | |||||||||||||

| Sector | NACE2 | 2016 3 | 2017 | |||||||||||

| Total | of which: | Total | of which: | |||||||||||

| Section & Division | United States | Japan | EU 284 | EMU 195 | Offshore Centres | United States | Japan | EU 284 | EMU 195 | Offshore Centres | ||||

| All Industries | 35,607 | -55,433 | 530 | -25,915 | -37,734 | 76,981 | -1,109 | -60,386 | -2,286 | 55,127 | 52,407 | 18,641 | ||

| Agriculture, Forestry and Fishing; Mining and Quarrying; Construction | A, B & F | * | * | 0 | * | * | * | * | * | 0 | * | * | 0 | |

| Total Manufacturing Sector | C | -2,767 | * | -135 | -10,983 | -6,604 | * | -28,338 | -30,563 | 129 | -3,279 | -5,669 | -1,023 | |

| Food, beverages and tobacco products | 10, 11 & 12 | -371 | * | 0 | 747 | * | * | 1,232 | * | 0 | * | * | 2,098 | |

| Textiles and wood | 13, 14 & 16 - 18 | * | 0 | 0 | * | * | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Basic pharmaceutical products and preparations | 21 | 9,187 | -252 | 248 | * | * | -681 | -4,664 | -4,642 | 11 | -2,444 | -2,612 | -1,563 | |

| Other manufacturing n.e.s. | * | -86,641 | -383 | * | 1,455 | 71,799 | -24,906 | * | 118 | * | * | -1,558 | ||

| Electricity, Gas, Steam and Air Conditioning supply | D | * | 0 | 0 | * | * | 0 | * | * | 0 | * | * | 0 | |

| Total Services Sector | 45 - 99 | 38,275 | 31,911 | 666 | -15,007 | -31,092 | 4,528 | 27,055 | -29,830 | -2,414 | 58,249 | 58,004 | 19,664 | |

| Wholesale and retail trade; Repairs of motor vehicles | G | * | * | * | 2,221 | 2,318 | * | 26,753 | * | -10 | * | * | * | |

| Transportation and storage | H | * | 0 | 0 | * | * | 0 | * | 0 | 0 | * | * | 0 | |

| Information and communication | J | 7,059 | 1,997 | 1 | 1,164 | 866 | 2,091 | 21,924 | * | 7 | * | * | * | |

| Financial intermediation | 64 | 1,890 | 16,027 | -199 | -16,355 | -30,806 | -3,349 | 5,804 | -12,191 | -2,319 | 37,252 | 39,425 | 2,152 | |

| of which: | ||||||||||||||

| Activities of holding companies | 64.2 | -1,639 | * | * | * | * | 147 | 1,474 | * | * | * | * | 1,246 | |

| Insurance, reinsurance and pension funding | 65 | 2,634 | 1,074 | 100 | -784 | 836 | 1,323 | 607 | -1,826 | * | 1,630 | 848 | 906 | |

| Other financial activities | 66 | 1,412 | * | * | * | 861 | * | 1,045 | * | * | 740 | 751 | * | |

| Other services activities6 | * | * | 570 | * | * | 3,078 | * | * | 37 | * | * | 484 | ||

| 1Data are provided according to arithmetic sign conventions. e.g. minus signs are used in cases where there is withdrawal of investment. | ||||||||||||||

| 2The activity classification used in this release is the NACE Rev. 2 classification. | ||||||||||||||

| 3Revised. | ||||||||||||||

| 4For analytical purposes, additional details are given of transactions between residents of Ireland and residents of the EU28 area. | ||||||||||||||

| 5The relevant EMU countries are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia and Spain | ||||||||||||||

| 6This covers residual FDI service activity | ||||||||||||||

| *Data suppressed for confidentiality reasons. | ||||||||||||||

| Table 7 Direct Investment1 Abroad End Year Positions Classified by Activity2 of Resident Investor | € million | |||||||

| Sector | NACE 2 | 2016 3 | 2017 | |||||

| Total | of which: | Total | of which: | |||||

| Section & Division | EU 284 | EMU 195 | EU 284 | EMU 195 | ||||

| All Industries | 812,639 | 597,792 | 483,677 | 717,133 | 496,005 | 387,693 | ||

| of which: | ||||||||

| Agriculture, Forestry and Fishing; Mining and Quarrying; Construction | A, B & F | * | * | * | * | * | * | |

| Total Manufacturing Sector | C | 62,750 | 26,377 | 18,472 | 72,889 | 35,553 | 26,368 | |

| Food, beverages and tobacco products | 10, 11 & 12 | 19,692 | * | * | * | * | * | |

| Textiles and wood | 13, 14 & 16 - 18 | * | * | * | * | * | * | |

| Basic pharmaceutical products and preparations | 21 | * | * | * | * | 916 | 788 | |

| Other manufacturing n.e.s. | * | * | 2,584 | 42,893 | * | 8,727 | ||

| Electricity, Gas, Steam and Air Conditioning supply | D | * | * | * | * | * | * | |

| Total Services Sector | 45 - 99 | 720,017 | 557,637 | 454,267 | 615,737 | 447,443 | 350,954 | |

| Wholesale and retail trade; Repairs of motor vehicles | G | 15,915 | 7,179 | 1,336 | 16,128 | 9,915 | 2,992 | |

| Transportation and storage | H | * | * | 0 | * | * | 0 | |

| Information and communication | J | 3,395 | 1,742 | 777 | 15,023 | * | * | |

| Financial and insurance activities | K | 91,524 | 19,152 | 5,106 | 86,826 | 15,737 | 2,999 | |

| of which: | ||||||||

| Activities of holding companies | 64.2 | 7,185 | * | * | 8,045 | 1,226 | 689 | |

| Other service activities6 | * | * | 447,048 | * | 407,259 | * | ||

| 1The sign convention used is: for year-end positions 'Abroad', an entry without sign indicates a net asset position, while a minus sign indicates a net liability position. | ||||||||

| 2The activity classification used in this release is the NACE Rev. 2 classification. | ||||||||

| 3Revised. | ||||||||

| 4For analytical purposes, additional details are given of transactions between residents of Ireland and residents of the EU28 area. | ||||||||

| 5The relevant EMU countries are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia and Spain. | ||||||||

| 6This covers residual FDI service activity. | ||||||||

| *Data suppressed for confidentiality reasons. | ||||||||

| Table 8 Direct Investment1 in Ireland End Year Positions Classified by Activity2 of Resident Enterprise | € million | |||||||||||||

| Sector | NACE2 | 2016 3 | 2017 | |||||||||||

| Total | of which: | Total | of which: | |||||||||||

| Section & Division | United States | Japan | EU 284 | EMU 195 | Offshore Centres | United States | Japan | EU 284 | EMU 195 | Offshore Centres | ||||

| All Industries | 797,521 | 223,600 | 2,409 | 322,167 | 218,003 | 152,949 | 744,386 | 178,992 | 428 | 326,468 | 241,739 | 142,977 | ||

| Agriculture, Forestry and Fishing | A | * | * | 0 | * | * | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Mining and Quarrying; Construction | B | * | 0 | 0 | * | 0 | 0 | * | * | 0 | * | * | 0 | |

| Total Manufacturing | C | 321,432 | * | 10 | 50,910 | 53,076 | 96,013 | 274,215 | * | 386 | 43,646 | 44,454 | 81,730 | |

| Food, beverages and tobacco products | 10, 11 & 12 | 5,351 | 4 | * | 5,128 | 11,075 | * | 3,959 | * | * | 3,277 | 7,078 | * | |

| Textiles and wood | 13, 14 & 16 - 18 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Basic pharmaceutical products and preparations | 21 | 68,450 | -1,850 | 281 | 29,665 | 28,619 | 12,939 | 55,865 | -4,780 | 308 | 23,403 | 21,926 | 9,672 | |

| Metal and mechanical products | 24, 25, 26 & 28 | * | * | * | 14,171 | 13,612 | * | * | * | * | 11,571 | * | * | |

| Other manufacturing | * | * | -34 | 1,946 | -230 | 8,122 | * | 3,172 | * | 5,395 | * | 8,082 | ||

| Electricity, Gas, Steam and Air Conditioning supply | D | * | 0 | 0 | * | * | 0 | * | 0 | 0 | * | * | 0 | |

| Total Services Sector | 45 - 99 | 475,127 | 73,587 | 2,399 | 270,298 | 164,665 | 56,936 | 469,122 | 75,032 | 42 | 281,775 | 196,969 | 61,247 | |

| Wholesale and retail trade; Repairs of motor vehicles | G | 17,261 | 3,661 | * | 7,595 | 6,486 | * | 43,303 | 2,087 | * | 10,551 | 9,552 | * | |

| Information and communication | J | 19,263 | * | -16 | 2,165 | 813 | 7,368 | 36,211 | -249 | -4 | 44,707 | 43,893 | -11,582 | |

| Financial intermediation | 64 | 204,413 | 29,412 | 273 | 108,281 | 44,093 | 28,053 | 197,283 | 45,649 | * | 110,852 | 68,598 | 24,102 | |

| of which: | ||||||||||||||

| Activities of holding companies | 64.2 | 21,381 | * | * | 7,172 | 7,007 | 6,922 | 20,353 | * | * | 6,115 | 5,923 | 6,963 | |

| Insurance services | 65 | 26,003 | 6,934 | * | 14,868 | 13,413 | 2,679 | 25,307 | 4,543 | * | 15,666 | 13,715 | 3,427 | |

| Administrative and support activities | N | 63,618 | 15,773 | 2,062 | * | -20,335 | 7,804 | 58,783 | 8,833 | 1,814 | 13,122 | -19,811 | 11,202 | |

| Other services activities6 | 144,569 | * | -29 | * | 120,195 | * | 108,235 | 14,169 | * | 86,877 | 81,022 | * | ||

| 1The sign convention used is: for year-end positions 'In Ireland' an entry without sign indicates a net liability position, while a minus sign indicates a net asset position. | ||||||||||||||

| 2The activity classification used in this release is the NACE Rev. 2 classification. | ||||||||||||||

| 3Revised. | ||||||||||||||

| 4For analytical purposes, additional details are given of transactions between residents of Ireland and residents of the EU28 area. | ||||||||||||||

| 5The relevant EMU countries are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia and Spain. | ||||||||||||||

| 6This covers residual FDI service activity | ||||||||||||||

| *Data suppressed for confidentiality reasons. | ||||||||||||||

| Table 9 Direct Investment Income1 Flows Classified by Geographic Location of Creditor/Debtor | € million | ||||||

| Region/Country | 2016 2 | 2017 | |||||

| Inflows | Outflows | Net | Inflows | Outflows | Net | ||

| Europe | 17,530 | 41,443 | -23,913 | 19,368 | 54,779 | -35,411 | |

| of which: | |||||||

| Belgium | 87 | 1,118 | -1,031 | 77 | 1,794 | -1,717 | |

| France | 156 | 2,067 | -1,911 | 149 | 1,908 | -1,759 | |

| Germany | 182 | 625 | -443 | 177 | 208 | -31 | |

| Italy | 62 | 1,501 | -1,439 | 14 | 2,408 | -2,394 | |

| Luxembourg | 10,488 | 5,239 | 5,249 | 9,594 | 12,219 | -2,625 | |

| Netherlands | 3,856 | 12,905 | -9,049 | 5,086 | 13,500 | -8,414 | |

| Spain | 62 | 243 | -181 | 5 | 428 | -423 | |

| Switzerland | -919 | 7,480 | -8,399 | * | 7,226 | * | |

| United Kingdom | 1,118 | 4,473 | -3,355 | 2,216 | 2,846 | -630 | |

| EU 283 | 17,654 | 28,869 | -11,215 | 18,827 | 36,718 | -17,891 | |

| EMU 194 | 15,271 | 23,845 | -8,574 | 15,459 | 32,561 | -17,102 | |

| Americas | 4,831 | 18,495 | -13,664 | 4,197 | 15,728 | -11,531 | |

| of which: | |||||||

| Canada | 0 | 54 | -54 | 27 | -34 | 61 | |

| United States | 2,314 | 2,481 | -167 | 1,171 | 2,907 | -1,736 | |

| Offshore centres | 2,395 | 15,969 | -13,573 | 2,847 | 12,860 | -10,013 | |

| Asia | * | 700 | * | * | 1,084 | * | |

| of which: | |||||||

| Japan | 64 | 454 | -390 | 22 | 365 | -343 | |

| Africa | * | * | * | * | * | * | |

| Oceania and Polar Regions | 95 | * | * | 1 | * | * | |

| Not geographically allocated5 | 434 | 357 | 77 | 713 | 423 | 290 | |

| Total | 18,383 | 61,056 | -42,673 | 20,728 | 72,048 | -51,320 | |

| of which: | |||||||

| Offshore centres6 | 3,150 | 20,891 | -17,741 | 4,109 | 24,129 | -20,020 | |

| 1Income on equity and other direct investment capital. | |||||||

| 2Revised. | |||||||

| 3For analytical purposes, additional details are given of transactions between residents of Ireland and residents of the EU28 area. | |||||||

| 4The relevant EMU countries are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia and Spain. | |||||||

| 5This category covers data supplied by respondents without a geographical breakdown. | |||||||

| 6This category overlaps with the regions referred to above and covers Andorra, Antigua and Barbuda, Anguilla, Netherlands Antilles, Barbados, Bahrain, Bermuda, Bahamas, Belize, Cook Islands, Curacao, Dominica, Grenada, Guernsey, Gibraltar, Hong Kong, Isle of Man, Jersey, Jamaica, St. Kitts and Nevis, Cayman Islands, Lebanon, Saint Lucia, Liechtenstein, Liberia, Marshall Islands, Montserrat, Maldives Nauru, Niue, Panama, Philippines, Singapore, St MaartenTurks and Caicos Islands, Saint Vincent and the Grenadines, British Virgin Islands, US Virgin Islands, Vanuatu, Samoa. | |||||||

| *Data suppressed for confidentiality reasons. | |||||||

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/fdi/foreigndirectinvestmentannual2017/